Warren Buffett, the famous investor and billionaire, often gives advice about money and investing. He’s known for his simple and practical approach, but some of his suggestions might seem unrealistic for people who don’t have a lot of money. One of his main pieces of advice is to invest in the stock market. Buffett believes that everyone should regularly invest in American companies. He says, “They should just keep buying and buying and buying a little bit of America as they go along. And 30 or 40 years from now, they will have a lot of money.”

For many people, especially those who don’t have much money, investing can seem impossible. Many live paycheck to paycheck and don’t have extra money to invest. Investing also involves risk, and for someone struggling financially, losing money in the stock market can be devastating. Additionally, not everyone knows how to invest or has access to good financial advice.

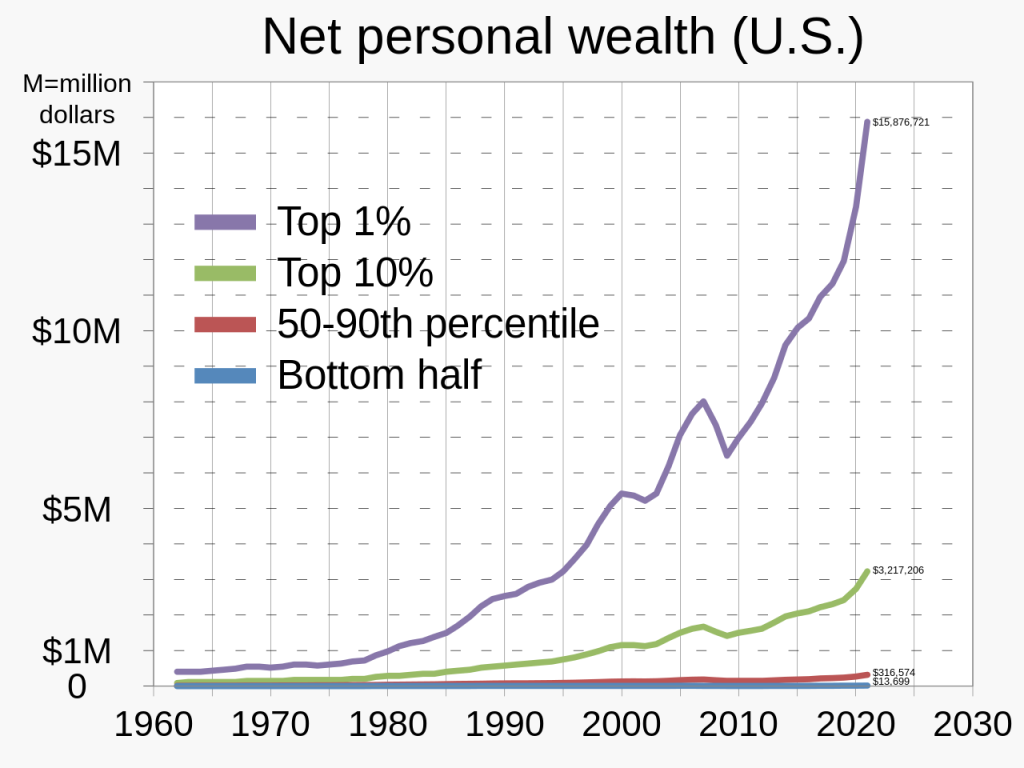

Buffett has said that the gap between the rich and the poor is a natural part of our advanced economy. He believes that our economy rewards people with specialized talents, which is why some people become very rich. For example, he mentioned that a couple of hundred years ago, it was very hard to get significantly wealthier than others because the economy was based on hard work. However, in today’s economy, having certain skills can make someone incredibly wealthy at a young age. He also said, “The poor are most definitely not poor because the rich are rich. Nor are the rich undeserving. Most of them have contributed brilliant innovations or managerial expertise to America’s well-being.”

This perspective, however, overlooks the systemic issues that contribute to poverty. Wealth accumulation by the rich often comes at the expense of the poor. High executive salaries, stock buybacks, and tax avoidance strategies increase the wealth of the rich while reducing the resources available for public services and fair wages. For example, companies that prioritize shareholder profits may cut costs by paying workers low wages, leading to a cycle where the rich get richer and the poor stay poor.

Buffett believes that the wealth gap is an inevitable consequence of an advanced market-based economy. He argues that while the economy rewards specialized talents, this creates a significant wealth gap. The modern economy requires more high-order talents, reducing the need for commodity-like tasks, which leaves many people behind. The key, according to Buffett, is to implement economic policies that provide a decent lifestyle for everyone willing to work, without distorting the market system.

Yet, this view ignores the structural barriers that prevent equal economic opportunity. Access to quality education, healthcare, and networks are often limited for the poor, creating a cycle of poverty that is hard to break. When the rich use their wealth to influence political decisions, they often push for policies that protect their interests, further widening the gap. This influence can be seen in tax policies that favor capital gains over income, which disproportionately benefits the wealthy.

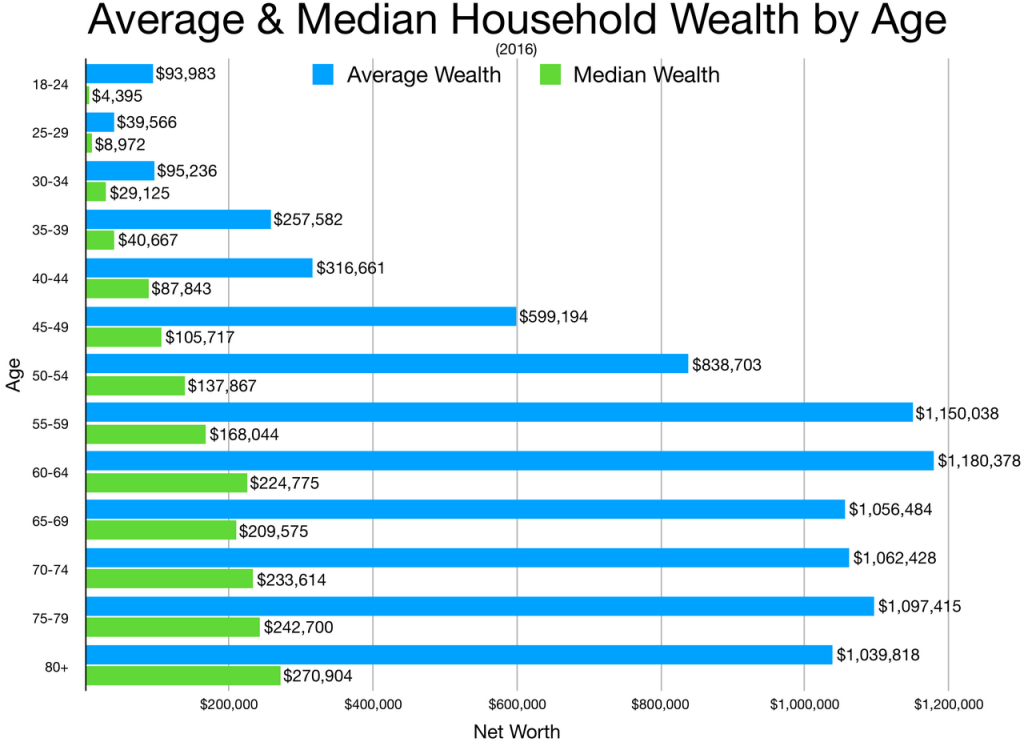

Buffett’s famous quote, “The rich invest in time, the poor invest in money,” highlights the disparity in financial opportunities. The poor often have to focus on immediate financial needs and cannot afford to invest for the future. Additionally, Buffett advises having multiple income streams, saying, “Never depend on a single income. Make investment to create a second source.” While this is sound advice, it assumes the ability to save and invest, which may not be feasible for many.

Buffett also stresses the importance of safety in investing, saying, “The three most important words in investing are ‘margin of safety.’” This means being careful and making sure you’re getting a good deal when you invest. However, the poor often do not have the luxury of taking such precautions. They are more vulnerable to economic downturns and have fewer resources to fall back on.

Despite Buffett’s well-meaning advice, it is important to understand that not everyone is in a position to follow his advice exactly. Investing can be a good way to grow your money, but it’s not the only way. Finding a balance that works for your situation and being aware of your financial limits is crucial. For many, starting small and being consistent can make a significant difference over time.

Understanding both the benefits and the challenges of investing can help low income earners make better decisions about their financial future. By considering Buffett’s advice and recognizing its limitations, young people can start building a solid financial foundation that takes into account their unique circumstances. However, it is also important to recognize the systemic issues that contribute to economic inequality and work towards solutions that provide fair opportunities for all.