Many businesses and individuals have left California. They thought that leaving the state would rid them of high taxes. Such wishful thinking may soon be a thing of the past. Some big names may be affected by Assembly Bill 259. The list already includes some fortune 500 companies but it is rumored Wells Fargo may soon be added to the list. Let us look at the companies who may be facing unexpected hurdles in the near future and those that may have escaped before the bill goes into effect. As currently written individuals with net assets below 50 million will not be affected. A link to the full text of the bill is at the end of the article.

Wells Fargo’s new Dallas-Fort Worth campus will span 850,000 square feet with two 10-story buildings and capacity to hold up to 4,000. Will Wells Fargo be moving its headquarters to Texas from California? If they don’t make the move before the new exit tax passes they may be the first to get to test it in court.

Chevron sold its headquarters building in San Ramon to move to Houston Texas in June 2022. They should avoid the exit tax although as they are still doing business in the state of California how their assets are classified may affect what they owe.

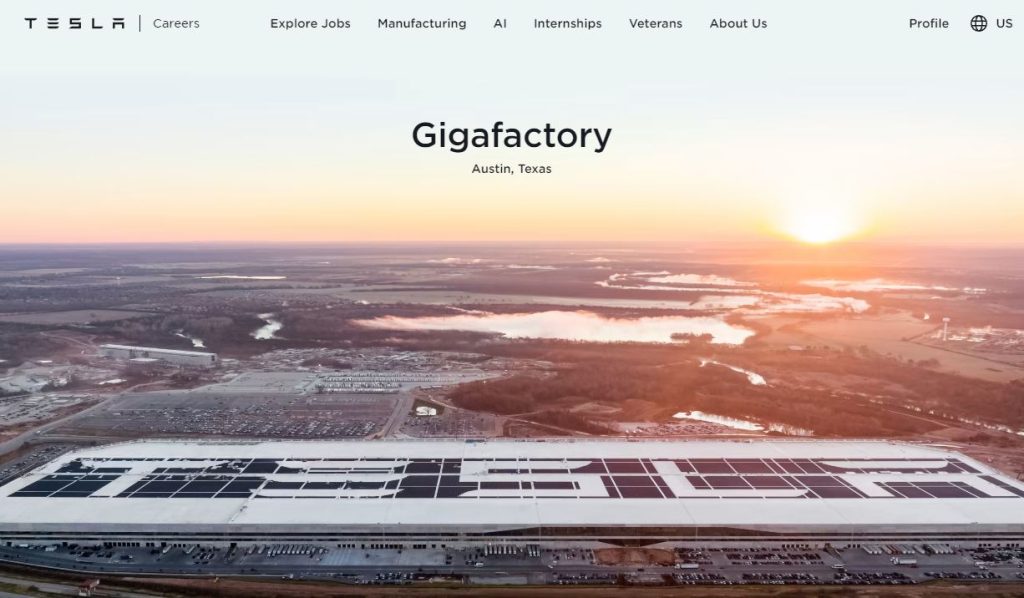

Tesla built its new gigafactory in Texas October 2021. Tesla still has a large presence in California and any other future plant moves could hit Tesla with some hefty exit taxes if the bill is signed into law by Newsom. The fact that this bill is even being considered could cause several companies to accelerate plans of moving out of state.

Charles Schwab an investment firm moved to Texas in 2021 likely avoiding the exit fee but the bill may also prove an issue with further acquisitions, will California based companies lose value for mergers and acquisitions going forward if the bill passes?

Getting out of the state just in time: FreshRealm a fresh meal solutions provider announced they will be shifting their California-based headquarters to Texas in March 2024.

Hodge, A logistics and materials handling business moved out of California to Iowa reported on November 3 2023. They should avoid the exit fee.

Noble 33 a hospitality business specializing in fine dining moved to Florida on October 31 2023. They should avoid the exit fee.

QuickFee, a software and online payment processing service moved to Texas on October 20, 2023. They should avoid the exit fee.

Advantage Solutions a Fortune 500 company moved its headquarters to Missouri in October 2023. They should avoid the exit fee.

Thermomix, an appliance manufacturer and distributor moved its operations to Texas in August 2023. They should avoid the exit fee.

Unical Aviation a global aircraft parts and components supplier moved to Arizona in July 2023. They should avoid the exit fee.

Ruiz Foods a large distributor of Mexican cuisine moved to Texas in May 2023. They should avoid the exit fee.

Cacique Foods a producer of Mexican cuisine move to Texas in May 2023. They should avoid the exit fee.

Inbenta an AI interactive software developer moved to Texas in March 2023. They should avoid the exit fee.

Landsea Homes a builder and designer of master-planned communities and homes moved to Texas March 2023. They should avoid the exit fee.

McAfee a software developer specializing in virus protection moved to Texas January 2023. They should avoid the exit fee although some portions of their business remain in California.

Boingo Wireless a connectivity provider and distributor of antenna systems moved to Texas in December 2022. They should avoid the exit fee.

Lucas Oil Products a manufacturer and distributor of engine additives moved to Indiana in November 2022. They should avoid the exit fee.

Home Franchise Concepts a home franchise distributor moved to Texas in October 2022. They should avoid the exit fee although some portions of their business remain in California.

Allspring Global Investments, a financial investment company moved to North Carolina in October 20 2022. They should avoid the exit fee although some portions of their business remain in California.

Obagi Cosmeceuticals a skin care products manufacturer and distributor left for Texas in September 2022. They should avoid the exit fee.

Belong a property management company moved to Florida in September 2022. They should avoid the exit fee although some portions of their business remain in California.

HBCU Hub a mobile app developer connecting students to admission offices moved to Texas in April 2022. They should avoid the exit fee.

The Boring Company, a tunneling boring company moved to Texas in April 18 2022. They should avoid the exit fee although some portions of their business remain in California.

Sendoso a leading sending platform moved to Arizona in April 2022. They should avoid the exit fee.

Ovation Fertility a fertility clinic operating multiple IVF labs moved to Tennessee in February 2022. They should avoid the exit fee.

Hyperion hydrogen based vehicle manufacturer moved to Ohio in February 2022. They should avoid the exit fee.

Review Wave a mobile app developer for the health care industry moved to Texas in January 2022. They should avoid the exit fee.

Nexen Tire, a tire manufacturer and distributor moved its corporate headquarters to Ohio in October 2021. They should avoid the exit fee.

Hall Technologies, an audio visual tech company moved to Texas in October 2021. They should avoid the exit fee.

First Foundation Bank a financial services company moved their corporate headquarters to Texas in September 2021. They should avoid the exit fee.

Flexible Funding a boutique lender should avoid the fee as they moved to Texas in August 2021.

HomeLight a real estate sales company should avoid the fee as they moved to Arizona in August 2021.

NinjaOne a software development company should avoid the fee as they moved to Texas in August 2021.

AECOM a diversified international company should avoid the fee as they moved from Los Angeles, CA, to Dallas Texas in October 2021.

MD7 a digital consulting company should avoid the fee as they moved to Texas in August 2021.

Kaiser Aluminum a manufacturing company should avoid the fee as they moved to Tennessee in July 2021.

Smart Wires, Inc. an energy products manufacturer should avoid the fee as they moved to North Carolina in July 2021.

Wiley X an optical products manufacturer should avoid the fee as they moved to Texas in June 2021.

F45 a fitness training company should avoid the fee as they moved to Texas in June 2021.

Edelbrock Group a performance engine parts manufacturer should avoid the fee as they moved to Mississippi in June 2021.

Landing, a large apartment rental company should avoid the fee as they moved to Alabama in June 2021.

Snowflake, a recruitment company should avoid the fee as they moved to Montana in May 2021.

Wedgewood LLC, a property development company should avoid the fee as they moved to Texas in May 2021.

GemCap a financier should avoid the fee as they moved to Texas in May 2021.

Green Dot Corporation a fintech firm and biggest U.S. provider of prepaid debit cards should avoid the fee as they moved its headquarters from Pasadena, California to Austin, Texas, in May 2021.

Education Media Foundation (EMF) a multimedia company should avoid the fee as they moved to Tennessee in March 2021.

Viavi Solutions a global leader in communications test and measurement and optical technologies should avoid the fee as they moved to Arizona in February 2021.

Align Technology a dental products manufacturer and provider should avoid the fee as they moved its global headquarters to Arizona in January 2021.

Digital Realty a data center providing connectivity solutions should avoid the fee as they moved to Texas in January 2021.

Lion Real Estate Group, a real estate company should avoid the fee as they moved to Texas in January 2021.

OPSWAT a digital security firm should avoid the fee as they moved to Florida in January 2021.

Oracle should avoid the fee as they moved its global headquarters from Silicon Valley to Texas in December 2020.

Hewlett Packard Enterprise (HPE) should avoid the fee as they moved to Texas in December 2020.

Pabst a beverage company should avoid the fee as they moved its headquarters to Texas in October 2020.

NortonLifeLock (Symantec) a digital security company should avoid the fee as they moved to Arizona in January 2020.

It’s clear that California law makers are attempting to stem the exodus of companies from California to more favorable jurisdictions. The question remains if Assembly Bill 259 will accomplish that goal and can it do it within the confines of the constitution.

The bill can be seen in its entirety here. There may be some issues according the American Bar Association with enactment.