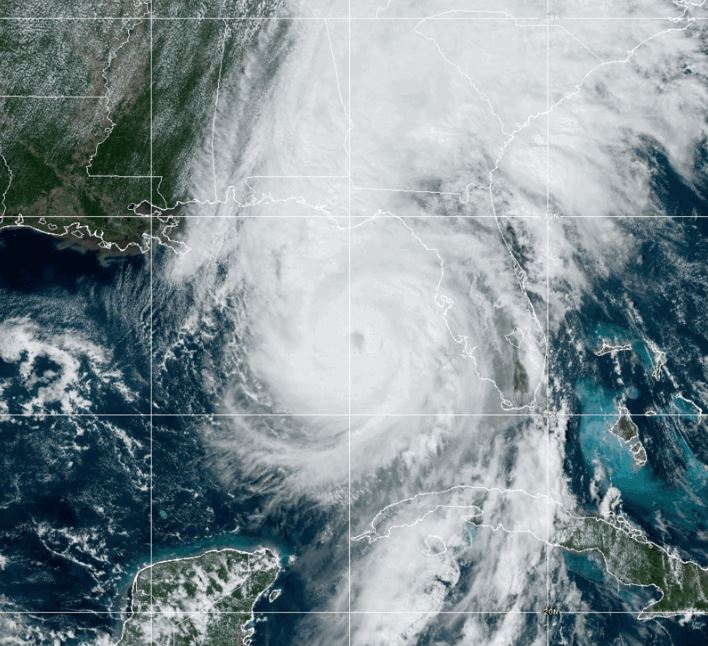

Florida’s Citizens Property Insurance Corporation appears to be in a strong position to handle the financial strain from Hurricane Helene, with early estimates placing insured losses between $3 billion and $5 billion. As the state-run insurer of last resort, Citizens has grown substantially in recent years, now covering over 1.3 million policies due to the retreat of private insurers from Florida’s high-risk areas.

Despite the significant damage caused by Helene, Citizens’ financial reserves and reinsurance coverage are expected to help it absorb the impact without needing additional public assessments or dramatic financial restructuring.

Citizens has built up more than $6 billion in reserves and secured substantial reinsurance agreements, ensuring that it can cover losses from storms like Helene. In addition, it has access to the Florida Hurricane Catastrophe Fund, which provides further financial backing during major storm events. The estimated losses from Helene fall within the range of Citizens’ anticipated capacity, allowing it to process claims efficiently while maintaining financial stability.

However, while Citizens is prepared to handle Helene’s damage, it is important to recognize that the 2024 hurricane season is still ongoing. Florida is only midway through the season, and the risk of additional hurricanes remains high. With the peak of the season typically falling between August and October, the potential for more storms to make landfall in Florida could place further pressure on Citizens’ financial resources.

Even though Citizens’ current financial strategy appears sound, the growing frequency and intensity of hurricanes, driven in part by climate change, raise concerns about the long-term sustainability of Florida’s insurance market. Citizens has made efforts to reduce its exposure by encouraging policyholders to move back to private insurers, but with the private market shrinking, this has been difficult. The future may require broader reforms in the insurance sector, including stronger building codes and more comprehensive risk management strategies to protect the state’s residents and economy.

For now, Citizens is expected to withstand the losses from Hurricane Helene, thanks to its strong financial foundation and access to reinsurance. However, with more storms potentially on the horizon, the insurer’s resilience will continue to be tested throughout the remainder of the hurricane season. The situation underscores the need for ongoing preparedness as Florida faces an increasingly volatile climate.