“So, I am one of those monkeys in the trees that scream and shout when I see danger. If you don’t know what I’m referring to, read this. On every trip to the grocery store, I find myself shocked at the total bill, and I keep looking through the receipt to find that one item that is sending it over the top. I never find one thing; it’s just that everything costs more, and it seems like it’s happening at an increasing pace. They keep telling us that inflation is transitory or that it’s leveled off. I don’t see it. So, I compiled a list of the 10 indicators that can be warning signs when a currency is about to go in the shitter. I’m not doing this to alarm anyone, but at the same time, who is going to tell you when it’s coming? Nobody in power, that is for sure. They will all just go out and start buying up tangible assets at a breakneck pace. It is a bit like that whole frog in the boiling pot of water bit; if it happens slowly enough, you won’t notice anything is wrong until it’s far too late. So here goes my 2 cents on what the indicators are telling me.”

Assessing the Risk of Hyperinflation for the U.S. Dollar

Hyperinflation, a rare and catastrophic economic event, can erode the value of a currency rapidly. To gauge the risk of hyperinflation for the U.S. dollar, we’ll examine various economic and geopolitical factors and assign a risk rating to each. We’ll then calculate an overall risk rating for hyperinflation based on these factors.

1. Inflation Trend: Rating: 6 (Moderate Risk)

In recent months, inflation in the United States has been on an upward trajectory. Concerns about rising consumer prices, supply chain disruptions, and increased demand have contributed to this trend. The Federal Reserve has characterized this inflation as transitory but remains vigilant.

2. Unprecedented Quantitative Easing: Rating: 8 (Very High Risk)

During the COVID-19 pandemic, the Federal Reserve engaged in an unprecedented level of quantitative easing (QE). This involved purchasing vast quantities of Treasury securities and mortgage-backed securities, leading to a significant expansion of the money supply.

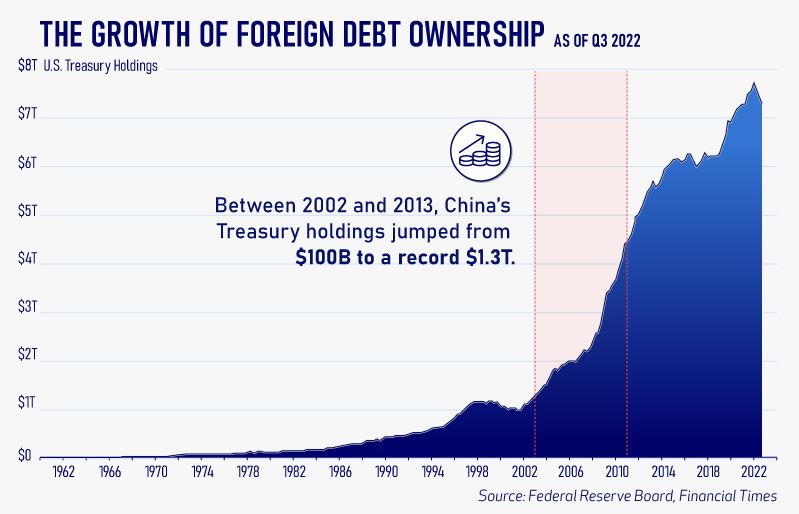

3. Loss of Confidence: Rating: 5 (Elevated Risk)

While the U.S. dollar still holds a dominant position as a global reserve currency, concerns about the national debt, budget deficits, and a declining share of global foreign-exchange reserves have raised questions about its long-term stability.

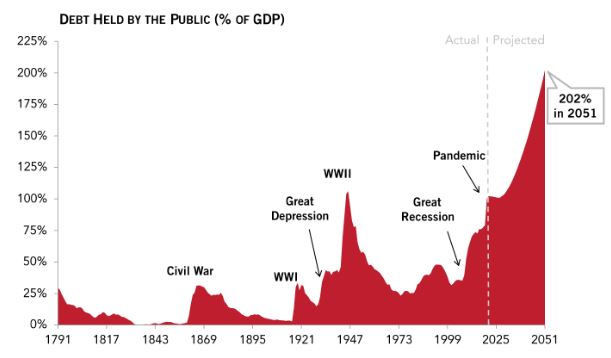

4. Large Budget Deficits: Rating: 7 (High Risk)

The United States has experienced substantial budget deficits, leading to concerns about long-term fiscal sustainability. Recent increases in government spending, particularly in response to the pandemic, have contributed to these deficits.

5. Global Economic Instability: Rating: 7 (High Risk)

Geopolitical tensions and conflicts have the potential to disrupt global economic stability. These disruptions can impact critical commodities such as grains, which are essential for food security worldwide.

6. Political Instability: Rating: 8 (High Risk)

The attempted insurrection at the U.S. Capitol in January 2021 highlighted significant political instability and polarization. These factors underscore potential risks to democratic institutions and the rule of law.

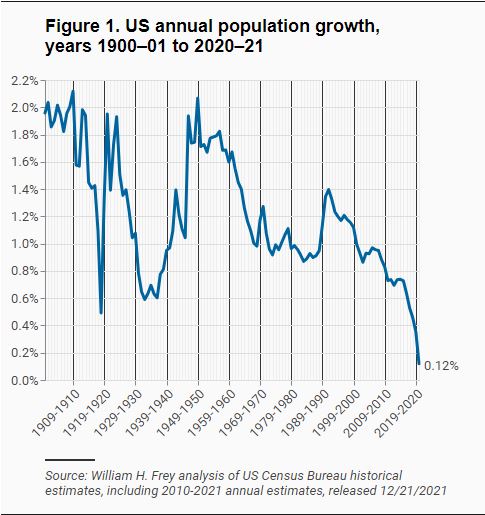

7. Population Growth as it Relates to Debt Servicing: Rating: 6 (Moderate Risk)

Current data indicates only marginal population growth in the United States, which contributes to economic activity and tax revenues. However, it may not fully offset the challenges posed by high levels of debt and deficits.

8. External Debt: Rating: 7 (High Risk)

The U.S. carries a substantial national debt, exceeding 100% of GDP. This level of debt raises concerns about long-term debt sustainability.

9. Natural Disasters: Rating: 6 (High Risk)

The United States has witnessed an increase in the frequency and severity of natural disasters, which strain government resources and budgets.

10. Pandemics: Rating: 7 (High Risk)

The COVID-19 pandemic had a profound impact on the U.S. economy, resulting in significant economic disruptions and challenges.

Summary of Hyperinflation Risk: Final Risk Assessment: 9

Based on the assigned ratings for each category, the overall risk of hyperinflation for the U.S. dollar is assessed at a final risk rating of 9 on a scale of 1 to 10. This reflects the overall risk of hyperinflation, considering the cumulative impact of having multiple high-risk indicators. Continuous monitoring and prudent economic policies are crucial to mitigate potential risks and maintain economic stability. Do we trust that they know what they are doing? Do we?… I don’t. My off the cuff prediction is a further raising of interest rates even beyond the Volcker hikes… strap in people.