October 6, 2024

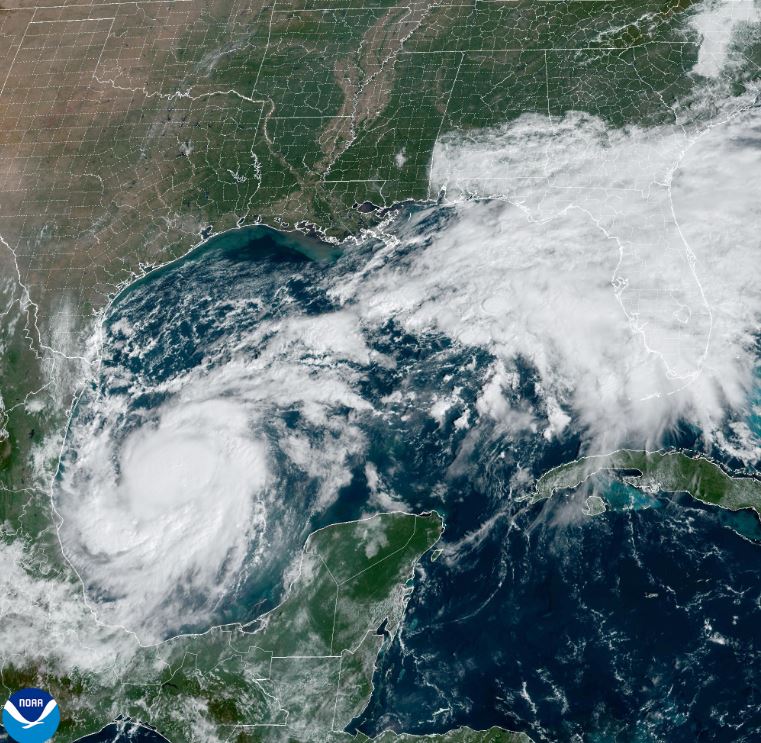

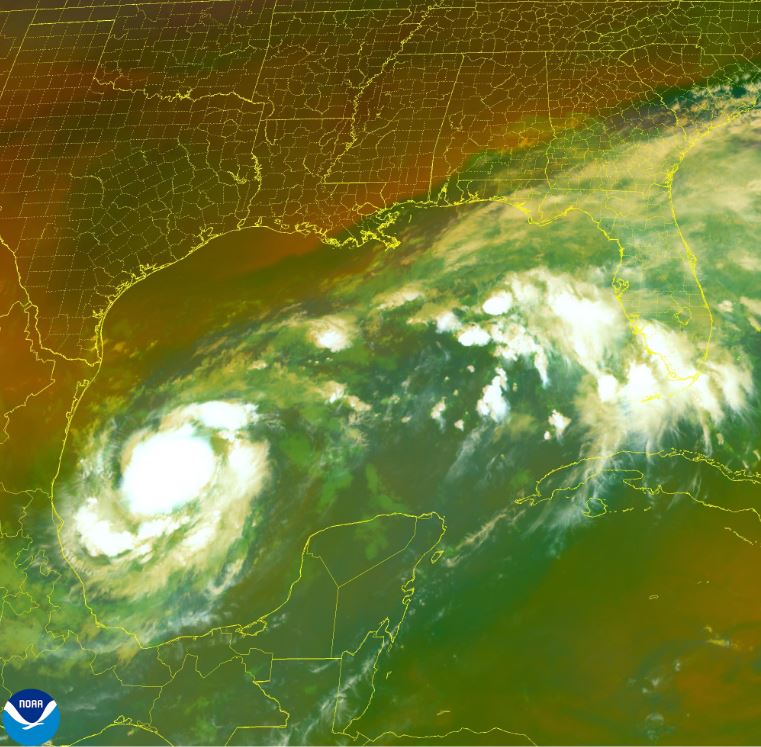

As Tropical storm Milton rapidly intensifies over the Gulf of Mexico and barrels toward Florida, concerns are mounting over the state’s largest insurer, Citizens Property Insurance Corporation, and its ability to weather yet another catastrophic event. Florida Governor Ron DeSantis has previously warned that Citizens could face insolvency if a major hurricane strikes, raising alarm as the storm approaches with potentially devastating consequences.

Citizens, which was created as the insurer of last resort for Floridians unable to secure private insurance, has been under pressure for years. The timing of Hurricane Milton could not be worse, as Citizens prepares to transfer more than 600,000 policies to private insurers in the coming weeks. This massive policy handover follows the devastation caused by Hurricane Helene just weeks ago, which left over 84,000 claims still unresolved.

In August, DeSantis cautioned that Citizens may not have enough reserves to withstand the financial strain of another major storm. “If a major hurricane hits, Citizens could be insolvent,” he said, emphasizing the need for Floridians to consider private insurance options. DeSantis has pushed for Citizens to depopulate by transferring policies to private insurers to mitigate the risk, but with Milton’s landfall imminent, that strategy faces a critical test.

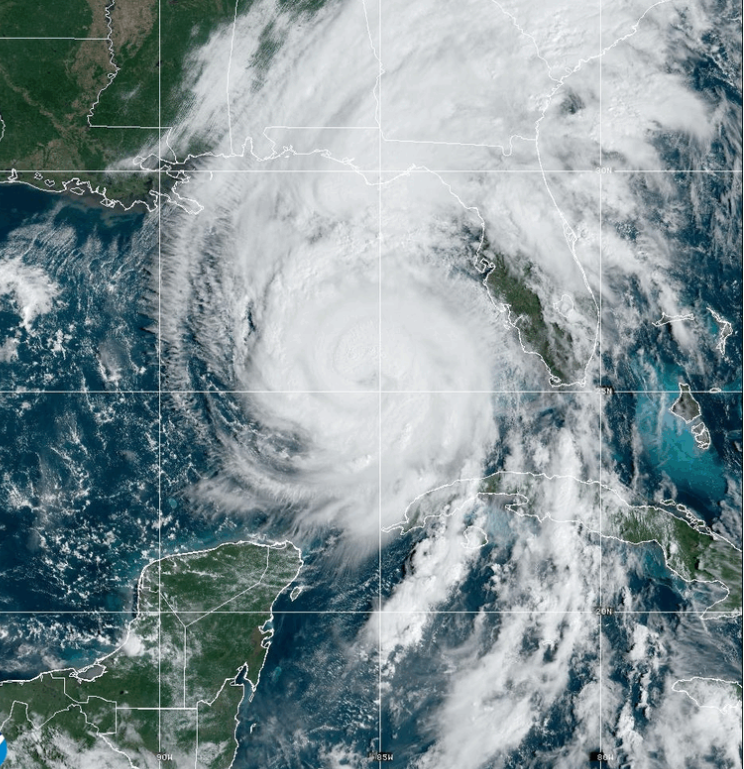

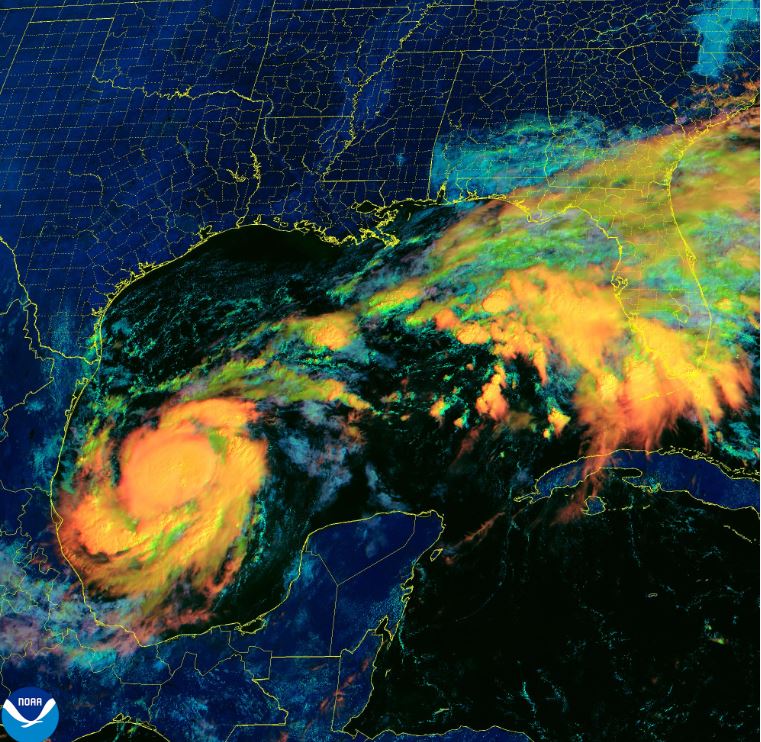

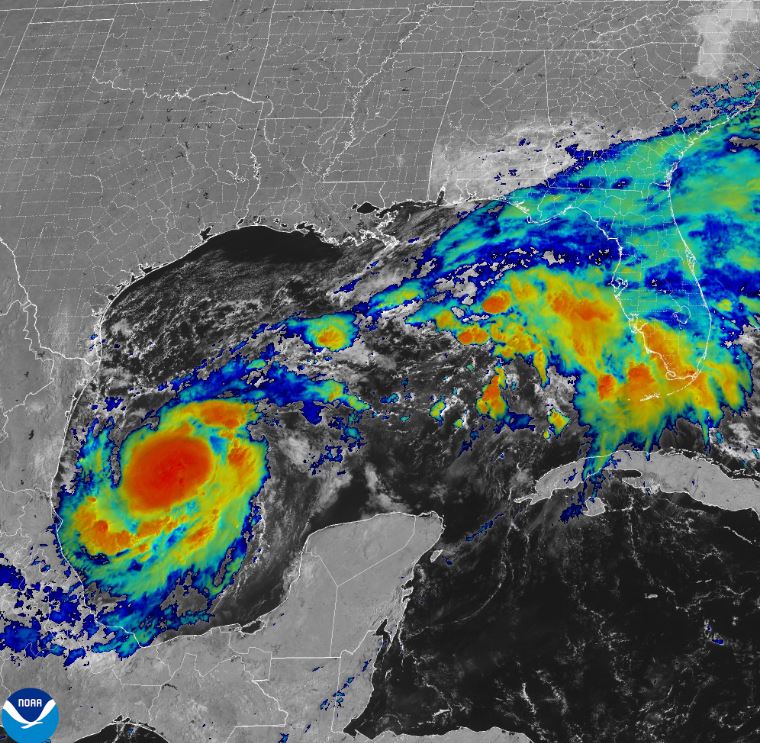

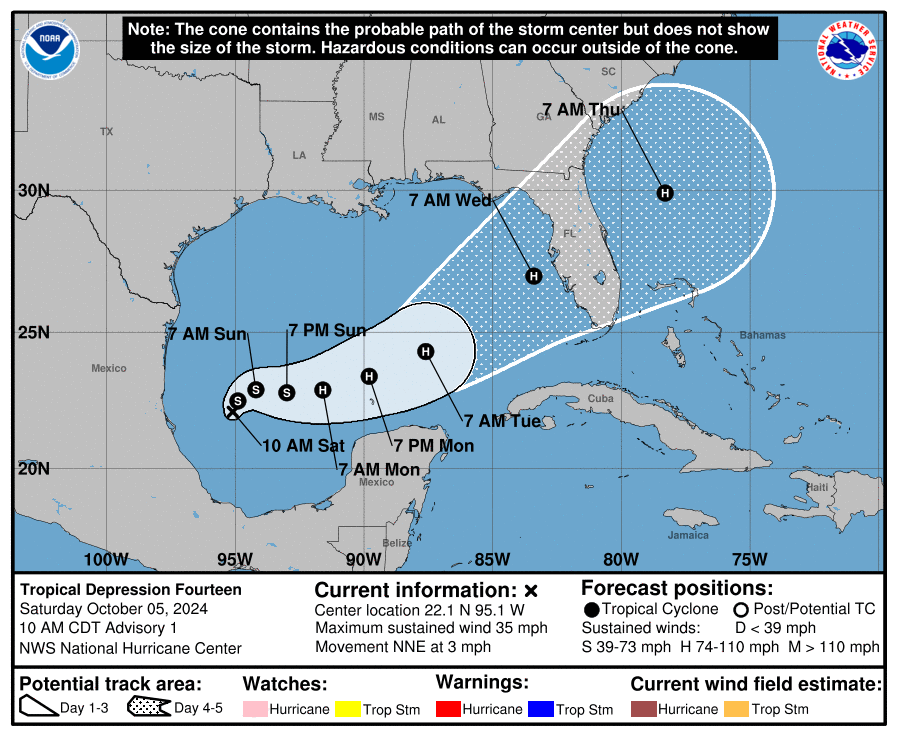

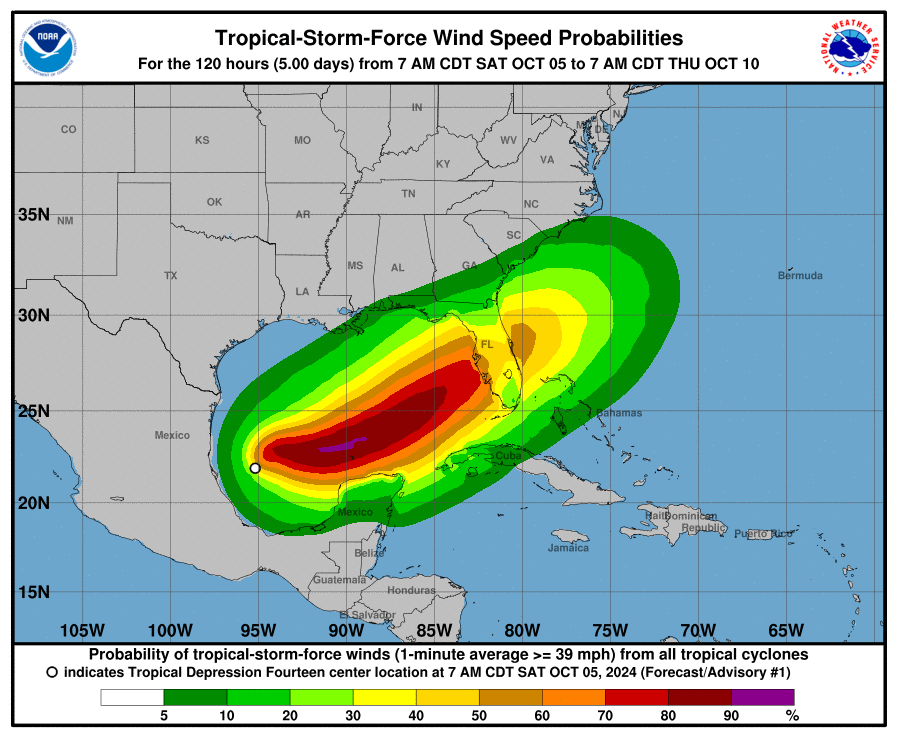

Hurricane Milton is forecast to become a major hurricane as it tracks toward Florida’s west coast by mid-week. Satellite and aircraft data show that the storm is rapidly intensifying, with a well-defined eyewall and maximum sustained winds expected to increase significantly. The National Hurricane Center (NHC) has warned that Milton will bring life-threatening storm surges, destructive winds, and heavy rainfall to the Florida Peninsula, adding to the strain on Citizens and the state’s broader insurance market.

Earlier this year, state regulators approved the transfer of 413,000 Citizens policies to private insurers starting in late October, with another 235,000 scheduled for removal in November. This move comes after Citizens saw a dramatic increase in policies over recent years, as private insurers withdrew from the Florida market or raised premiums due to rising losses from hurricanes and litigation. As of August 2024, Citizens had 1.25 million active policies, compared to just 420,000 five years ago.

However, with more than 600,000 policies in the process of being transferred, the timing of Hurricane Milton could complicate an already fragile situation. The state’s insurance infrastructure is under enormous pressure, and the potential for catastrophic damage from Milton could push it to the brink. As the state’s largest insurer, Citizens holds a significant portion of the Florida insurance market, and the risk of insolvency looms large if claims from Helene and Milton overwhelm the company’s reserves.

Florida homeowners are already grappling with some of the highest home insurance premiums in the nation. Many fear that the combination of Milton’s potential destruction and the depopulation of Citizens policies could leave them without viable insurance options in the future. As Milton approaches, there are growing concerns that the storm could expose deeper cracks in Florida’s insurance system, leaving thousands of residents without adequate coverage.

The NHC has advised that Milton’s exact track remains uncertain, but residents on Florida’s west coast should prepare for severe impacts, including storm surges and significant wind damage. With claims from Hurricane Helene still unresolved and the system facing the additional burden of Milton, Florida’s insurance market could be facing a financial reckoning.

Insurance Commissioner Michael Yaworsky has attempted to reassure Floridians that the policy transfers will stabilize the market, allowing private insurers to spread out the risk. But with over 600,000 policies being transitioned and tens of thousands of claims expected from Milton, the challenge ahead is unprecedented. For Governor DeSantis, the threat of Citizens becoming insolvent adds another layer of urgency to an already fraught situation.

As Hurricane Milton accelerates toward Florida, the coming days will be crucial for the state’s homeowners, insurers, and policymakers, as they brace for the storm’s potential devastation. Whether Florida’s largest insurer can withstand another blow remains to be seen, but the warning signs are clear: the future of Citizens Property Insurance—and Florida’s insurance market as a whole—hangs in the balance.