With Reddit set to go public this month it’s time to take a closer look at their business model and future prospects. It has been a long while since a top tier internet company has gone public and this one in particular has an interesting backstory.

It was the sub reddit Wallstreetbets on reddit that launched the failing business model of GameStop into the stratosphere, costing a few short hedge funds to rethink the traditional short strategies of the past. The hedge funds have gone so far as to actually now monitor social media sites like reddit for potential pitfalls.

Reddit is a social media platform where anonymous users exchange information and ideas across a diverse category range. There is some concern that a publicly traded company will not be able to host some of the content currently on the site. Wall Street tends to avoid certain industries all together and many funds may leave it out of their portfolio lineup depending what content Reddit chooses to keep around after the IPO. This could cause a revolt among reddit’s users, time will tell.

Reddit primarily earns its revenue through advertising efforts. In 2023, advertising constituted a whopping 98% of its total revenue, reaching $804 million. The remaining 2% was generated from premium subscriptions and user economy products like Reddit Gold and Avatars. These are digital items that users can buy for themselves or other users as gifts to show appreciation for their contributions.

Understanding Reddit’s revenue streams requires analyzing two key metrics: the number of users and the average revenue per user. These metrics are crucial for evaluating any advertising-driven business.

Let’s first consider the number of users. Reddit provides two main metrics: Daily Active Unique (DAUq) and Weekly Active Unique (WAUq). The Daily Active Unique in the U.S. amount to 36 million, while the Weekly Active Unique are around 131 million. These metrics give us different perspectives on Reddit’s market penetration.

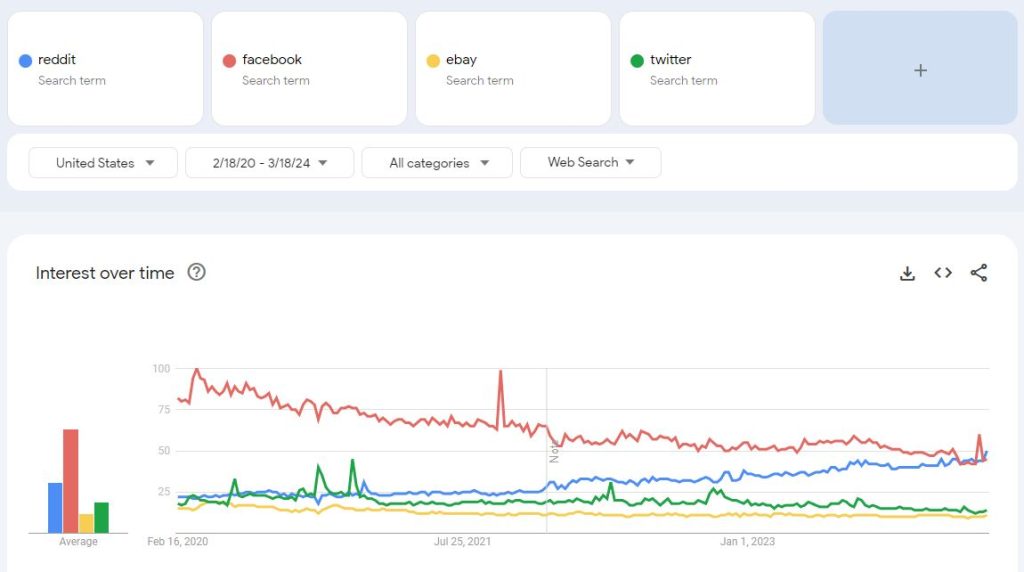

If we look at reddit’s long term interest trend it shows steady up growth, with interest recently surpassing even Facebook.

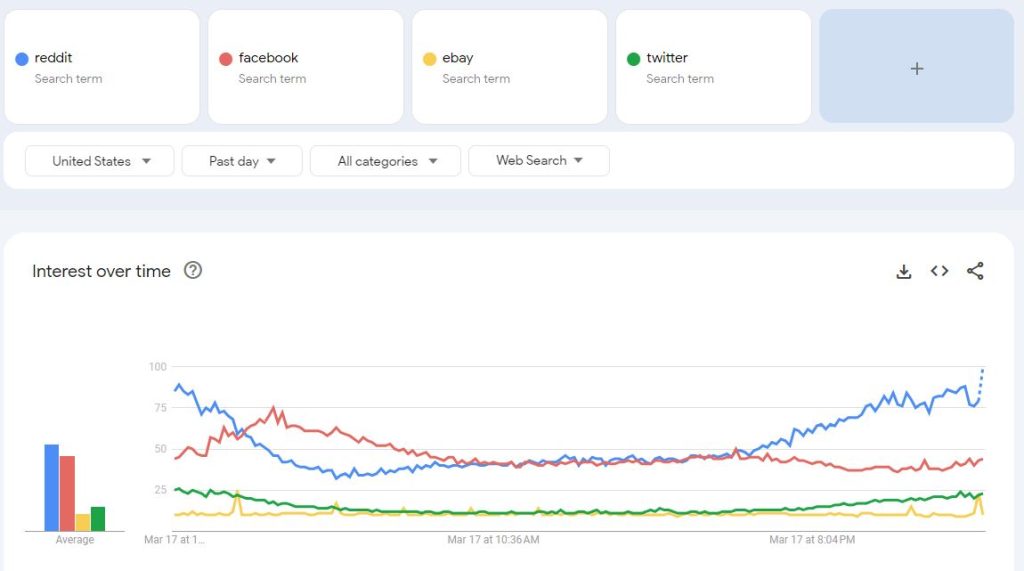

Even more interesting is what the interest shows near the date of the IPO, with only 3 days to go until the IPO interest has entered the “breakout” level of 100. This could be a sign that interest in the IPO will be high on opening day. Whether those interested parties will be buying or selling remains to be seen.

Using these metrics, we can estimate Reddit’s penetration rate, which helps gauge its growth potential. However, determining the exact penetration rate is complex due to factors like occasional users and Reddit’s evolving user base.

While Reddit may seem saturated in the U.S. if we use the estimated 270m potential users (over the age of 14) they may be close to 50%; There’s significant room for growth internationally. However, the revenue per user is roughly 4 times lower outside the U.S., which impacts Reddit’s overall future potential value.

Looking ahead, Reddit’s data assets present an intriguing opportunity. Its vast repository of human experiences and conversations holds considerable value, as evidenced by recent partnerships. Namely a $60m dollar agreement with Google that will let Google train their AI on Reddit’s dataset. These data assets could be a key revenue stream in the future and are a wild card in their evaluation model.

Despite Reddit’s long history, profitability remains elusive. High research and development (R&D) expenditures, accounting for 55% of revenue in 2023, contribute to ongoing losses. Reddit’s revenue growth is modest, signaling challenges in sustaining momentum.

With an expected valuation exceeding $5 billion, Reddit’s IPO raises questions about its future trajectory. While additional capital could provide liquidity for stakeholders, it also raises concerns about executive compensation and the company’s long-term strategy.

Reddit’s IPO filing marks a significant milestone, but uncertainties persist regarding its valuation and future prospects. As investors evaluate Reddit’s worth, understanding its revenue streams and growth potential is essential.

Disclaimer/Disclosure: The content on the Site is being provided for information purposes only. The Site does not provide tax, legal, insurance or investment advice, and nothing on the Site should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security or other instrument of investment. Always consult a licensed financial advisor regarding any investment decision.