Imagine a scenario that keeps American car companies awake at night: Chinese car manufacturers set up factories in Mexico to take advantage of North American trade rules. They then flood the U.S. market with very cheap electric vehicles (EVs). This scenario poses a significant threat to the American auto industry, particularly to major players like Tesla, Ford, and Chevrolet, which could face substantial layoffs as a result.

These Chinese EVs, selling at ultra-low prices, become popular across the U.S. In contrast, American-made EVs, which cost an average of $55,000, struggle to compete. This price difference is significant because Chinese EVs could be half the price of American ones. As a result, American factories might close, and many workers in the auto industry could lose their jobs, including those at Tesla, Ford, and Chevrolet.

This situation is not new. In the past 25 years, American industries, from steel to solar panels, have been hurt by cheaper, government-supported Chinese competition. Now, the fear is that the same could happen with electric vehicles, which American car companies see as their future. Tesla, Ford, and Chevrolet are heavily invested in the EV market, making this threat particularly alarming.

The Alliance for American Manufacturing has called the potential influx of low-cost Chinese EVs an “extinction-level event” for the U.S. auto industry. This means that American carmakers could face a huge threat to their survival if Chinese EVs dominate the market, leading to widespread layoffs in their workforces.

One major concern is the U.S.-Mexico-Canada Agreement (USMCA). This trade deal allows cars made in Mexico to enter the U.S. either duty-free or with a very low tariff of 2.5%. This would make it easy for Chinese EVs assembled in Mexico to be sold in the U.S. at much lower prices. However, even if Chinese EVs are assembled in Mexico, they would still need to pass U.S. crash tests and meet stringent U.S. regulations before they could be sold in the country. Many Chinese vehicles might struggle to meet these safety and regulatory standards, which could limit their entry into the U.S. market.

The U.S. has several options to address this threat. Customs officials could decide that Chinese EVs do not qualify for the low-tariff benefits of the USMCA. Policymakers could pressure Mexico to prevent Chinese cars from being assembled there. Another option could be to ban Chinese EVs from entering the U.S. on the grounds of national security.

The timing of this threat is critical. U.S. automakers, including Tesla, Ford, and Chevrolet, are already facing slow EV sales due to high prices and a lack of charging stations. Many American consumers are hesitant to buy EVs because of these issues.

Cheaper Chinese EVs could help by lowering prices, increasing sales, and encouraging investment in more charging stations. Some experts believe that allowing Chinese EVs into the U.S. could benefit the market by making EVs more affordable and widespread. However, this would come at the cost of jobs in the American auto industry.

We can draw a parallel with the computer market to understand this phenomenon better. Just as the influx of cheap, foreign-made computers drastically reduced prices and made them accessible to everyone, the entry of low-cost Chinese EVs could significantly lower car prices in the U.S. market. This might lead to a rapid increase in EV adoption, but it could also mean severe job losses for American auto workers, similar to how U.S. manufacturing jobs were impacted by cheaper electronics.

China currently leads the world in EV production. Last year, China made nearly 62% of the 10.4 million battery-powered EVs produced globally, while the U.S. produced only about 1 million. This shows how far ahead China is in the EV market, putting even more pressure on U.S. automakers like Tesla, Ford, and Chevrolet to compete.

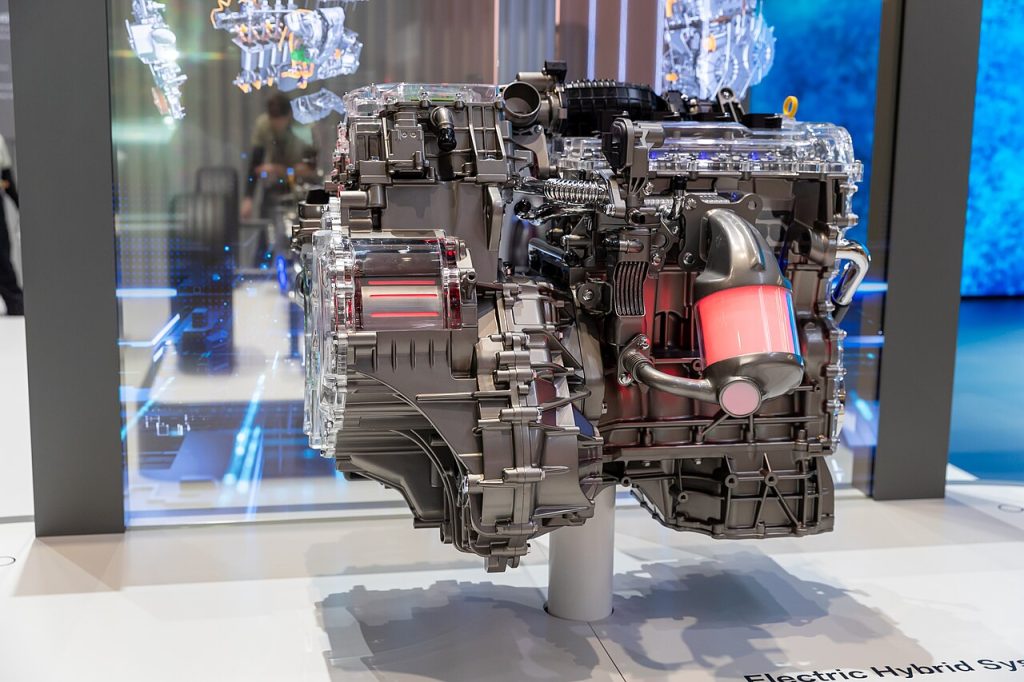

Chinese automakers have become very good at reducing costs. For example, China’s BYD introduced a small EV called the Seagull, which sells for just $12,000 in China. This car is designed to go farther on a smaller battery, making it very efficient. BYD is considering building a factory in Mexico to serve the Mexican market.

Critics argue that Chinese EV makers benefit from heavy government subsidies. The Chinese government spent over $130 billion on EVs and other green vehicles from 2009 to 2021. These subsidies help Chinese companies keep their prices low, adding to the competitive pressure on American manufacturers.

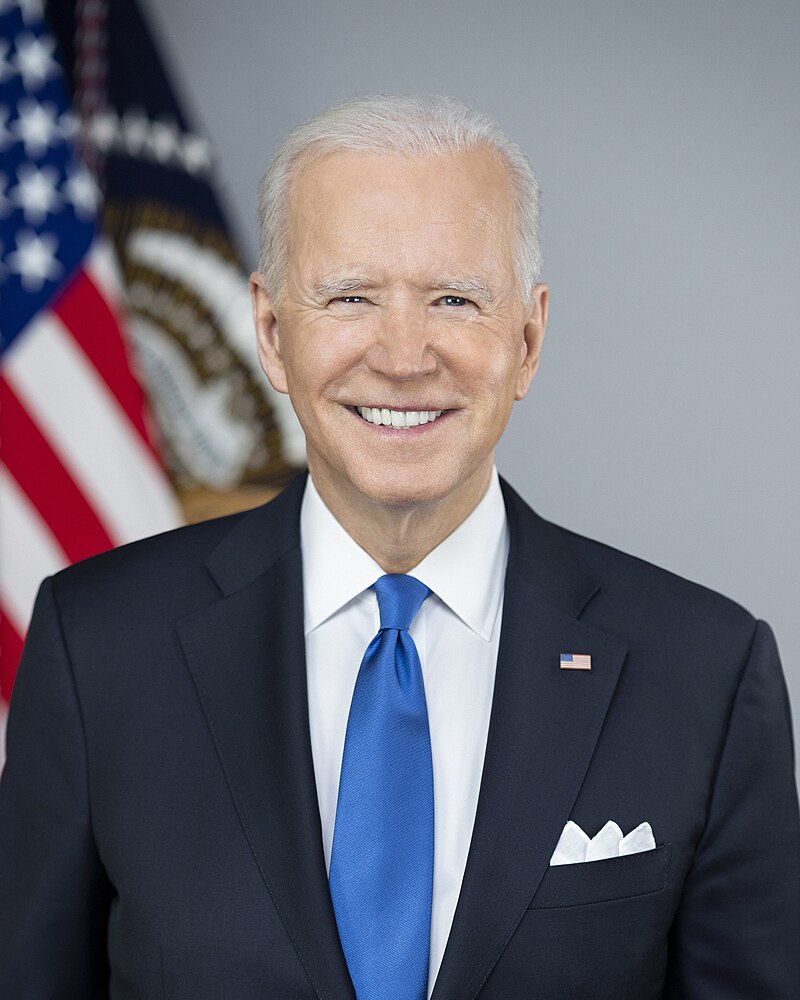

In response, President Joe Biden recently raised tariffs on Chinese EVs from 27.5% to 102.5%, making it very expensive to import them into the U.S. This high tariff aims to keep even low-cost Chinese EVs, like the BYD Seagull, out of the U.S. market. The European Union also plans to impose tariffs on Chinese EVs.

Despite these tariffs, the USMCA could still allow Chinese EVs made in Mexico to enter the U.S. with low or no tariffs. To qualify, at least 75% of the car and its parts must come from North America, and at least 40% of the car must be made in places where workers earn at least $16 an hour. Meeting these requirements is challenging, even for North American automakers.

Chinese EV makers could bypass the high tariffs by showing that their assembly process in Mexico transforms the cars into Mexican products. If they succeed, they would only face a 2.5% tariff.

In February, President Biden asked the Commerce Department to investigate the technology in Chinese “smart cars.” This investigation could lead to a ban on Chinese EVs if they are found to pose a national security threat. The U.S. government is taking these steps to protect the American auto industry and prevent significant layoffs at companies like Tesla, Ford, and Chevrolet.