Investing in any financial asset requires careful analysis of market trends, economic indicators, and political influence. A recent example that raises important considerations for investors is the partisan push by U.S. politicians, particularly Congressman Matt Gaetz and former President Donald Trump, in support of Bitcoin. While such endorsements can generate significant interest and even short-term price spikes, they should also give investors pause, prompting them to consider the broader implications of political advocacy on financial investments.

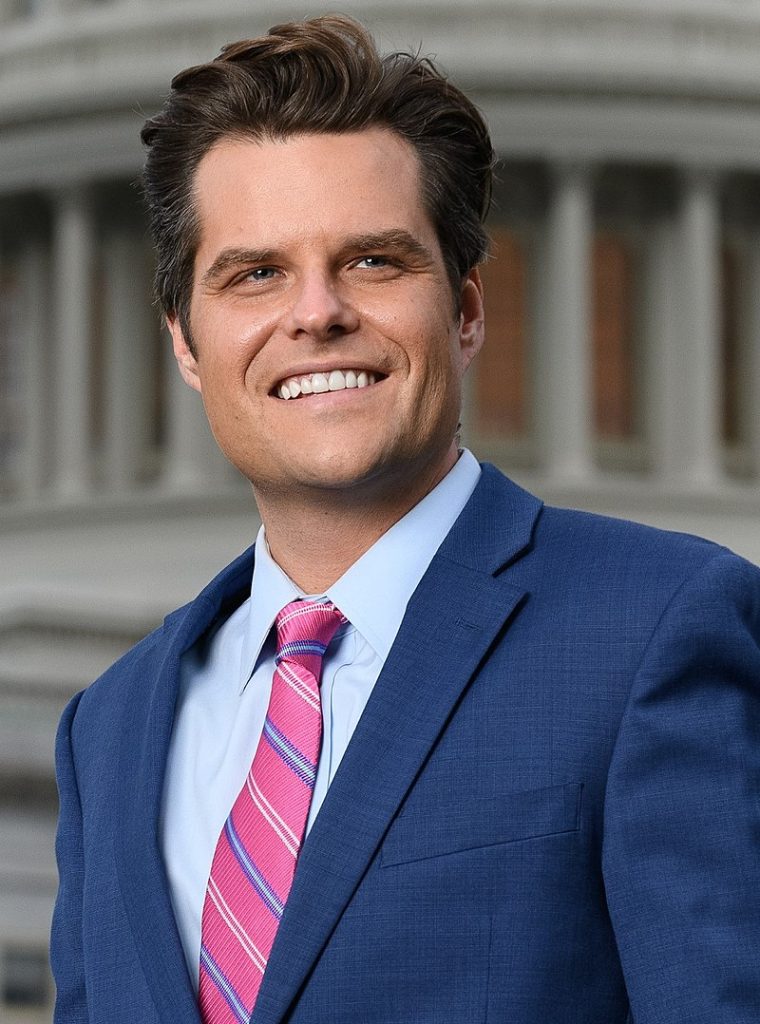

Congressman Matt Gaetz has emerged as one of the most vocal proponents of Bitcoin in the U.S. political sphere. Recently, Gaetz, along with Congressman Vicente Gonzalez, spearheaded efforts to adjust U.S. foreign policy in favor of El Salvador, a country that has embraced Bitcoin as legal tender under President Nayib Bukele. Gaetz’s support for Bitcoin is not limited to international matters; he has also proposed legislation that would allow U.S. federal income tax payments to be made in Bitcoin. This move, if successful, could significantly integrate Bitcoin into mainstream U.S. financial operations.

The proposed bill aims to amend the Internal Revenue Code of 1986, introducing a framework for the U.S. Treasury to accept Bitcoin payments for federal taxes. This would involve converting received Bitcoin to its dollar equivalent immediately, ensuring stability in the transaction. Gaetz has framed this initiative as a step toward innovation and efficiency in the financial system, positioning the U.S. at the forefront of technological advancement.

While the support of influential politicians can lend legitimacy to a financial asset, it also introduces risks that investors must carefully consider. Political figures, including Gaetz, have their own agendas, which may not always align with the long-term stability or growth of the asset they endorse. In the case of Bitcoin, the cryptocurrency’s association with high-profile political figures could lead to increased volatility, particularly if political dynamics shift.

Gaetz’s advocacy for Bitcoin comes with a significant critique of the Federal Reserve, as he has co-sponsored a bill aimed at abolishing the central bank. This anti-establishment stance may appeal to certain investors, but it also adds a layer of unpredictability to Bitcoin’s future. If Bitcoin becomes a political tool, its value could be influenced more by political maneuvers than by fundamental economic factors, making it a more volatile and less predictable investment.

Gaetz’s involvement with El Salvador’s Bitcoin experiment further complicates the investment landscape. El Salvador, under President Bukele, has embraced Bitcoin as legal tender and is doubling down on its commitment to the cryptocurrency by proposing the establishment of a Bitcoin bank. While this might seem like a bold move towards financial innovation, the real-world outcomes of El Salvador’s Bitcoin experiment are still uncertain. Investors should be wary of the potential for increased risk, as the success or failure of such a national-level adoption of Bitcoin could have ripple effects on its global perception and value.

Investors should approach the intersection of politics and cryptocurrency with caution. The support of prominent figures like Matt Gaetz and former President Trump can certainly drive interest and even temporary price increases in assets like Bitcoin. However, the long-term value of an investment should be based on sound economic principles rather than political endorsements.

Political support can be fleeting, and the volatility it introduces may not align with every investor’s risk tolerance. Before making investment decisions based on political advocacy, it is crucial to conduct thorough research and consider the potential for increased risk and instability. In the case of Bitcoin, while its adoption and integration into mainstream financial systems are notable developments, investors must weigh these against the inherent risks posed by its political backing.

Political endorsements, especially from influential figures like Matt Gaetz and former President Trump, can offer insights into the potential direction of certain investments, including Bitcoin. However, investors should remain vigilant, understanding that such endorsements often come with an agenda that may not align with long-term financial stability. As Bitcoin continues to evolve within the global financial system, it is essential to distinguish between genuine economic potential and the influence of political rhetoric, ensuring that investment decisions are based on sound analysis rather than fleeting political trends.