As private insurance companies pull out of high-risk areas across the United States, the growing crisis in home insurance is becoming impossible to ignore. California, one of the nation’s largest markets, is a stark example of this trend. State Farm, the largest home insurer in the state, has issued a grim warning: without significant premium hikes, it may not have the funds to cover claims by 2028. The company is demanding increases as high as 52% for renters and 30% for homeowners, or it will stop covering many properties entirely.

The problem extends far beyond California. Major insurers like Allstate and Farmers have already limited or stopped offering coverage in high-risk areas due to the rising costs associated with climate-related disasters.

More than half of Californians report that they have been affected by rising insurance premiums or have been dropped by their insurer. These homeowners are left with few alternatives, as private insurers are fleeing the market.

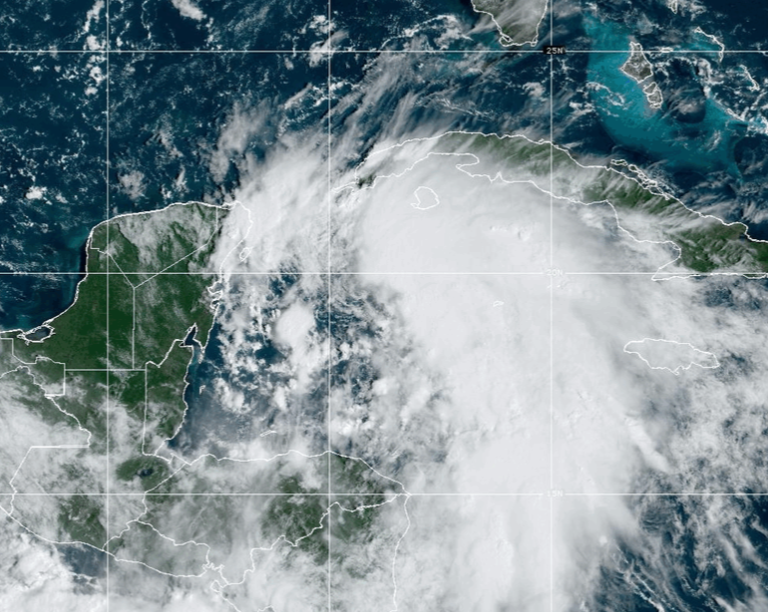

Florida has faced similar challenges in the wake of repeated hurricanes, but the state has responded with a public solution: Citizens Property Insurance Corporation. Citizens Insurance, created under Governor Ron DeSantis, is a state-run program that insures properties when private companies refuse to do so. While this offers relief to some, Citizens primarily covers high-risk properties, limiting its ability to create a stable market. This model, while helpful in times of disaster, shows the limitations of focusing only on the highest-risk properties.

For a national insurance program to be effective, it cannot follow the model of insuring only the most vulnerable. Instead, the risk needs to be spread across a larger pool, with coverage for a broad range of properties—not just those in high-risk zones. Nationalizing insurance would provide a comprehensive solution that doesn’t leave homeowners at the mercy of private insurers’ profit margins.

One of the most significant benefits of a nationalized insurance system would be the ability to base premiums on the actual risk associated with a property’s location. Under the current private insurance model, companies are driven by profits, often leading to unaffordable premiums in areas prone to wildfires, hurricanes, or floods.

A government-run insurance program could base rates on objective factors, like the address of a property, ensuring more affordable coverage. Flood insurance is already done this way. This would also prevent the inefficient practice of repeatedly rebuilding homes in disaster-prone areas. If a property experiences two or more total losses in a pre defined period, it would no longer qualify for government-backed insurance, encouraging smarter development in safer areas.

Florida’s Citizens Insurance provides a clear example of how public insurance can help homeowners, but it also highlights the need for a more expansive approach. Citizens Insurance is primarily focused on high-risk properties, which means it is vulnerable to the very disasters it is designed to address. By covering a broader range of properties, a nationalized system could be more financially stable and capable of withstanding large-scale claims without needing massive taxpayer bailouts.

The growing insurance crisis, particularly in states like California and Florida, demands a bold solution. Nationalizing insurance offers a path forward that would stabilize the market, ensure affordable premiums, and reduce the financial strain on both homeowners and the government. As climate change continues to fuel natural disasters across the country, the need for comprehensive, reliable insurance is more urgent than ever. A national insurance system, modeled after programs like Florida’s Citizens Insurance but expanded to cover all properties, is a solution whose time has come.