As of January 1, 2025, California drivers will be experiencing a significant increase in their auto insurance premiums, following the implementation of Senate Bill 1107. This law, signed by Governor Gavin Newsom in 2022, has raised the minimum auto coverage requirements across the state, leading to higher costs for motorists.

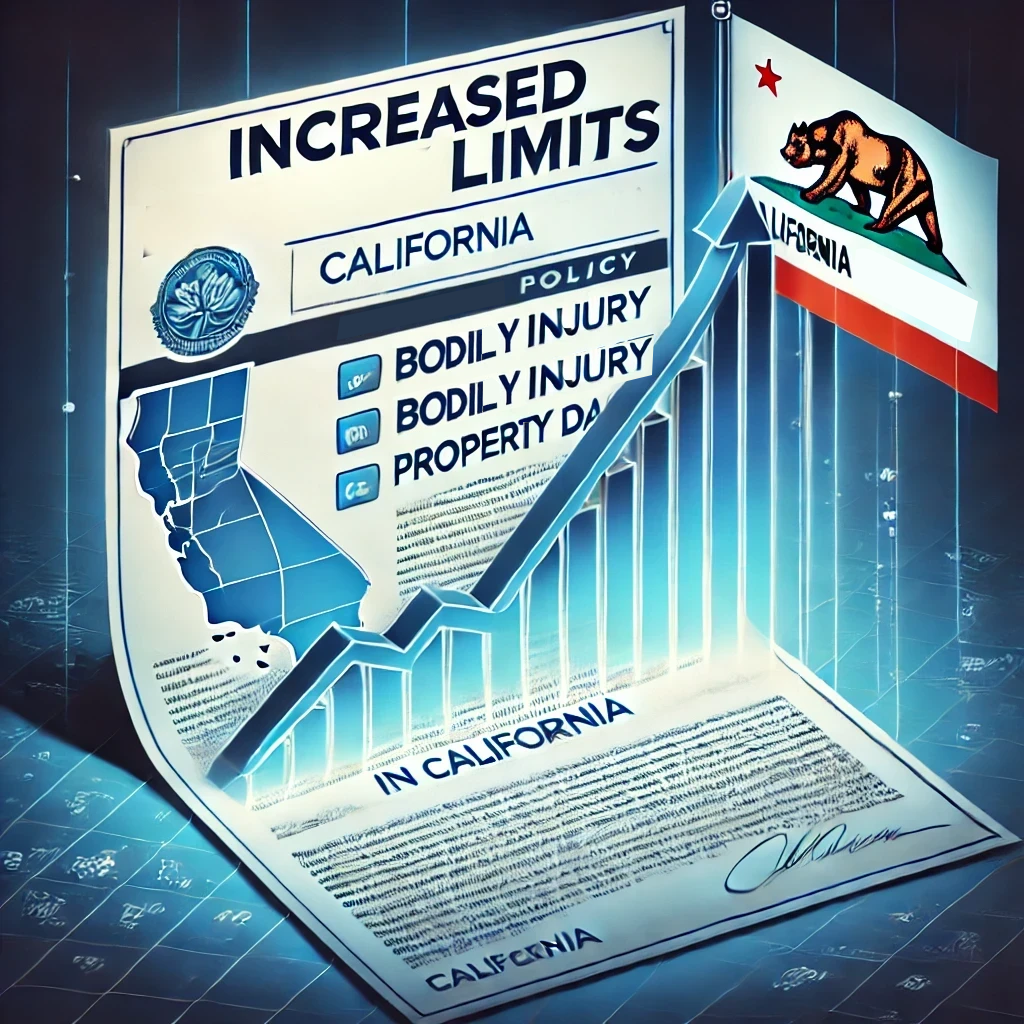

The new law has doubled, and in some instances tripled, the liability limits on auto insurance policies. For example, the minimum coverage for bodily injury or death of one person in an accident has increased from $15,000 to $30,000. Additionally, the coverage for property damage per accident has risen from $5,000 to $15,000. While these changes are intended to offer greater financial protection for drivers involved in accidents, they also come with a notable rise in insurance premiums.

The increased liability limits have placed a greater financial burden on insurance companies, which have passed these costs onto consumers. An online insurance marketplace has highlighted that while these higher limits provide better protection, they have also contributed to the rising auto insurance rates in California.

This increase comes at a time when auto insurance costs are already a major concern for drivers across the country. According to a report from Insurify, a data provider for auto insurance rates, the average U.S. insurance policy is expected to climb by 22% in 2024, reaching an annual premium of $2,469. This follows a 24% increase in 2023, indicating a continuing trend of escalating insurance costs.

California, in particular, is among the states most affected by this surge. The Insurify report predicts that California drivers could see their rates spike by as much as 54% this year, making it one of the states with the highest expected increases, alongside Minnesota and Missouri.

Several factors are driving these rising costs beyond the new legislative requirements. The increasing frequency and severity of weather events, such as hailstorms, have resulted in more vehicle damage and higher insurance claims. Hail-related auto claims, for example, accounted for 11.8% of all comprehensive claims in 2023, up from 9% in 2020. These climate-related events are adding to the pressure on insurance companies, leading to further premium hikes.

The cost of repairing vehicles after accidents, including labor and parts, has surged by more than 40%. The growing involvement of attorneys in accident claims, which often results in higher settlements, is also contributing to the increase in insurance rates.

In California, the situation is exacerbated by the state’s high rate of vehicle thefts. According to the National Insurance Crime Bureau, California led the nation in vehicle thefts last year, further inflating insurance costs in the state.

The impact of the COVID-19 pandemic is also lingering in the auto insurance industry. During the pandemic, California and other states imposed freezes on rate increases, but these restrictions have since been lifted, allowing insurers to adjust rates to reflect the current market conditions.

While SB 1107 was designed to enhance financial protection for California drivers, it has also led to a substantial increase in auto insurance premiums. With the new requirements now in effect, California residents are facing higher insurance costs, adding to the financial pressures already affecting many households in the state.