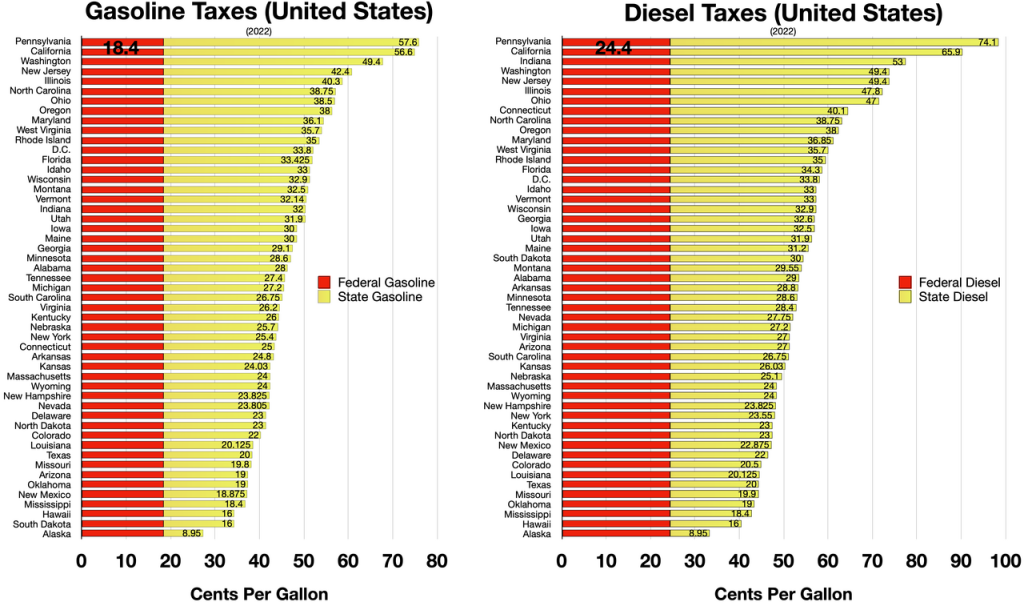

California motorists are bracing for another hike in gas taxes come July 1. The state’s excise tax on gasoline is set to increase from 57.9 cents to 59.6 cents per gallon, according to an announcement from the California Department of Tax and Fee Administration. This move is part of an ongoing trend that has seen the tax more than double since June 2017, when it stood at just 27.8 cents per gallon.

The increase in the excise tax isn’t confined to gasoline. Diesel fuel will also see a bump up from 44.1 cents per gallon to 45.4 cents. These increases are a continuation of California’s aggressive taxation policy on motor fuels, which is aimed at funding various state transportation and environmental initiatives.

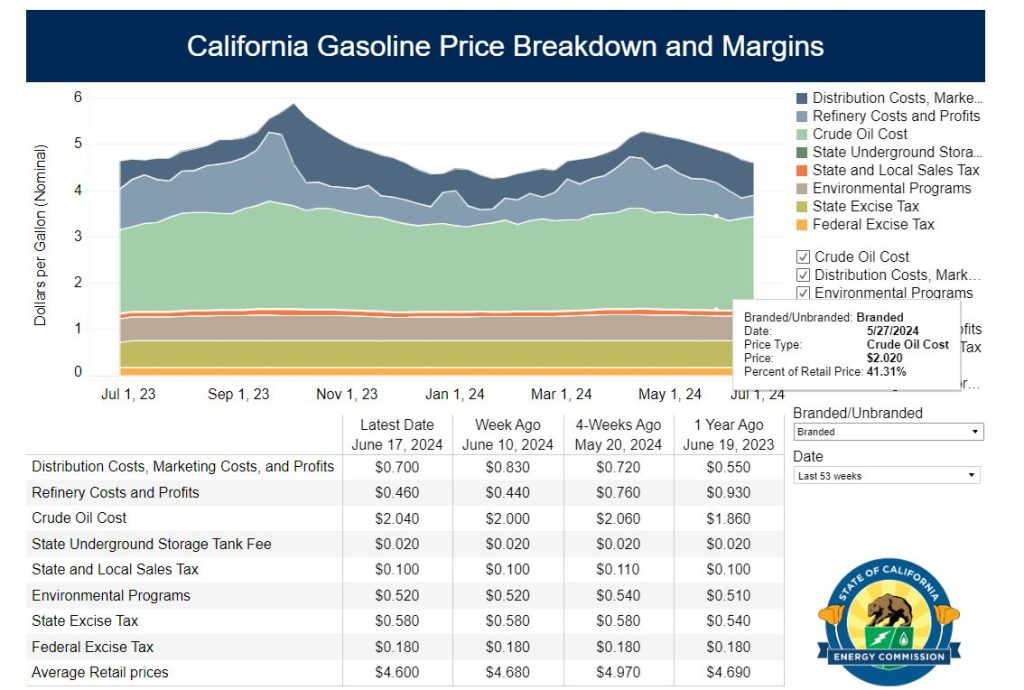

It’s noteworthy that these taxes come on top of several other costs borne by California drivers. Aside from the state excise tax, there is a federal fuel tax of 18.4 cents per gallon. Additionally, there are charges related to the state’s low-carbon fuel standard, the cap-and-trade program, state and local sales taxes, and fees for the maintenance of underground fuel storage facilities. When combined, these taxes and fees can add approximately $1.21 to the cost of a gallon of fuel priced at $5.

Interestingly, a recent report by the California Energy Commission highlighted that the total government take from these taxes and fees substantially exceeds the profit margins of gasoline refiners. For instance, on April 29, the combined refinery costs and profits amounted to roughly $1.01 per gallon, with figures dipping as low as 30 cents per gallon earlier in the year.

The tax adjustments were communicated through a notice on the California Department of Tax and Fee Administration’s website, primarily intended for retailers. This notice was straightforwardly titled, “Tax Rates for Motor Vehicle and Diesel Fuels.”

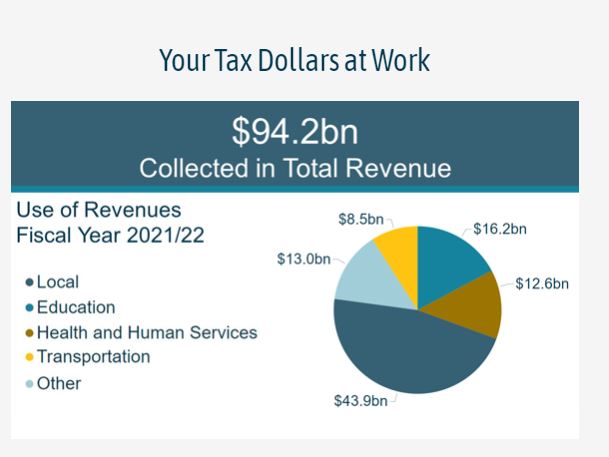

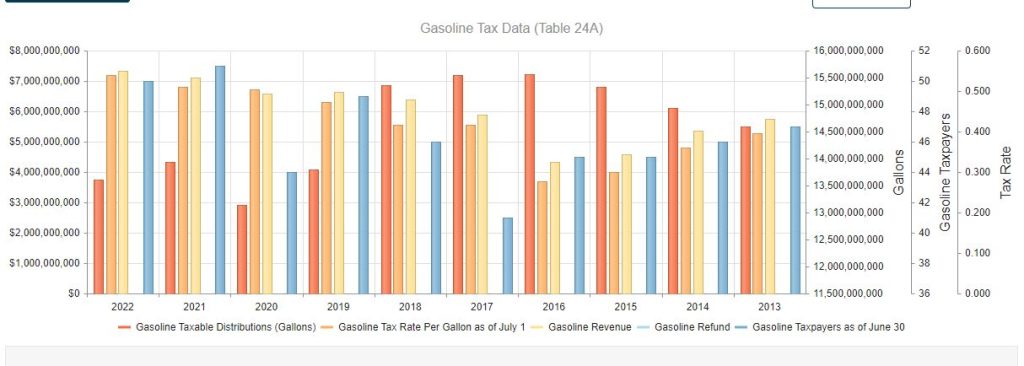

California’s dependency on fuel taxes for road maintenance is becoming increasingly problematic as the state pushes towards electrification of its vehicle fleet. The shift is significant, with over 1.2 million electric vehicles (EVs) already on California roads. This transition is gradually eroding the traditional gas tax revenue, a crucial source for infrastructure funding.

The decline in gas tax revenues due to the rise in EV adoption could potentially create a $4.4 billion shortfall in the state’s budget over the next decade. This alarming prospect has prompted state officials to consider alternative methods of taxation. “On average, Californians pay about $300 a year in state gas taxes,” noted Lauren Prehoda, a spokesperson for the California Department of Transportation, in an interview with KABC in Los Angeles.

In response, California is experimenting with a new tax system that charges drivers based on miles driven rather than fuel consumed. This pilot program seeks to establish a more equitable taxation mechanism, especially in light of the growing number of EVs that contribute less through traditional gas taxes. Volunteers participating in the mileage tax pilot can earn incentives totaling up to $400, which includes payments at the beginning and end of the trial period, and a bonus for consistent payment of mileage fees.

While California pioneers this change, other states are also exploring similar measures. States like Utah and Oregon already have voluntary mileage tax programs, while others such as Hawaii, Massachusetts, and Washington are discussing or have introduced legislation concerning mileage-based taxes.

In contrast, states like Texas have opted to impose additional registration fees on EV owners to make up for lost gas tax revenues. This varied approach across the nation highlights the ongoing evolution in how states adapt to changing transportation and environmental priorities.