The insurance crisis in Florida has reached unprecedented levels, with many national insurance companies fleeing the state due to skyrocketing risks from increasingly frequent hurricanes. As local private insurers also cancel policies, many Florida homeowners find themselves turning to Citizens Property Insurance Corp., the state-backed nonprofit intended as an insurer of last resort. Now, as hurricanes Milton and Helene ravage Florida, Citizens is faced with billions of dollars in potential claims, raising significant concerns about the insurer’s solvency and, more importantly, the ethical implications of its funding structure.

Citizens Insurance, once a niche provider designed to cover those who could not find affordable insurance in the private market, now holds 1.3 million policies — three times as many as five years ago. With private insurers retreating, Citizens has become the dominant player in Florida’s home insurance market. As it continues to grow, so do the risks associated with its unique funding model, which could leave non-homeowners footing part of the bill for damages caused by hurricanes. If a 45% assessment on policy holders is not enough to cover the losses, then non policy holders will start footing the bill up to a 12% premium surcharge on insurance policies state wide.

This moral hazard arises from the structure of Citizens Insurance. In the event of a shortfall, Citizens is allowed to impose surcharges on its own policyholders and, crucially, on other Florida residents with unrelated insurance policies — including those for autos, boats, and even pets. This means that Floridians who do not own property, and thus do not directly benefit from the coverage provided by Citizens, could still see their insurance premiums rise to cover the losses from homeowners’ claims.

The ethical problem with this structure is clear. Renters, boat owners, and others who have no stake in rebuilding damaged homes could be forced to pay for the risks and losses of property owners. This creates a scenario where individuals with no ownership interest in high-risk properties are subsidizing those who have chosen to live in areas prone to hurricanes and other natural disasters.

Given that the only way to qualify for Citizens Insurance is if the lowest quote from a private insurer is more than 20% greater than Citizens’ offer, the program is designed to provide relief to homeowners facing steep premiums. Yet, as climate change increases the frequency and intensity of storms in Florida, the reliance on non-homeowners to cover the costs of property damage through surcharges creates a moral hazard, effectively shifting the financial risk to those who bear none of the benefits.

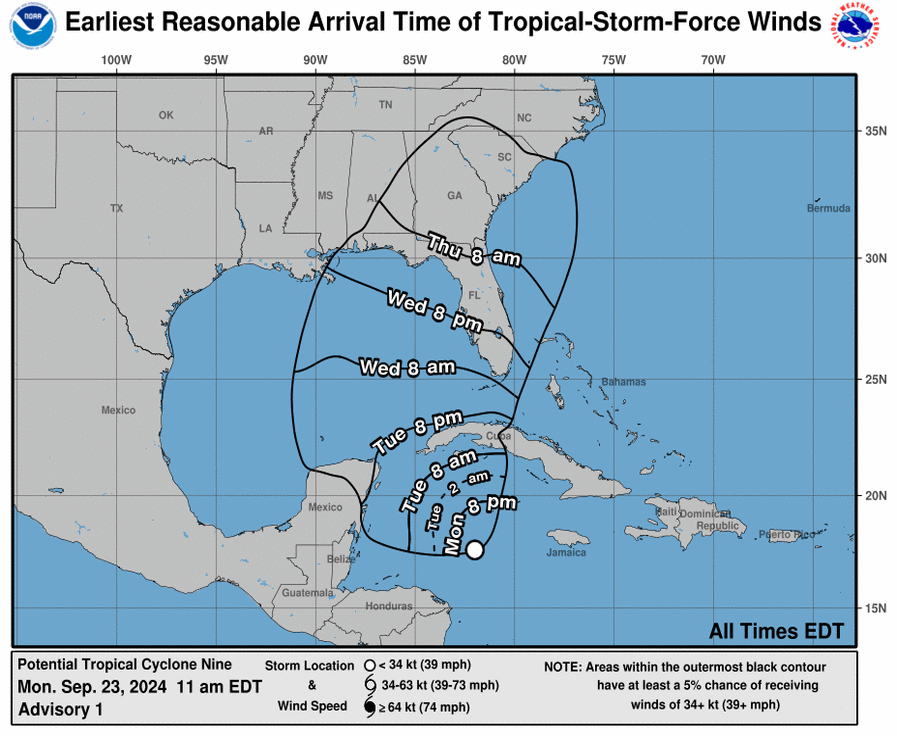

Citizens cannot go bankrupt in the way that private insurers might, which provides some reassurance to homeowners. The state-backed insurer had around $14 billion in reserves and reinsurance policies to help cover claims before the recent hurricanes. However, Florida Governor Ron DeSantis and others have warned that Citizens is just one catastrophic storm away from financial disaster. Florida just had two back to back hurricanes and the season is far from over.

If claims exceed Citizens’ ability to pay, the burden will fall not just on policyholders but also on the broader Florida population through surcharges on other types of insurance. This mechanism allows Citizens to maintain financial solvency, but at the cost of placing an unfair financial burden on people with no direct benefit from the insurer’s coverage.

The current situation in Florida underscores a broader issue in disaster-prone regions: when private insurers exit the market due to unmanageable risks, state-run insurers like Citizens fill the void. However, relying on a broader pool of residents to cover these costs, including those who do not own homes, raises serious ethical questions about fairness and responsibility.

In the long term, Florida may need to rethink how it structures its insurance market, particularly as climate change intensifies the risks. Insulating non-homeowners from the costs of rebuilding high-risk properties is a key challenge. Allowing premiums to rise for those who choose to live in vulnerable areas might be necessary to prevent a moral hazard where those with no stake in rebuilding are forced to bear the financial consequences.

Florida’s Citizens Insurance has become a lifeline for homeowners left without private insurance options, but its funding structure creates a moral hazard. Relying on surcharges from non-homeowners to cover the costs of rebuilding others’ homes is not only unfair but also economically unsustainable in the long run. As hurricanes continue to batter Florida, state leaders must confront the ethical and financial dilemmas posed by this system and consider reforms that balance the needs of homeowners with the fairness owed to the broader public.