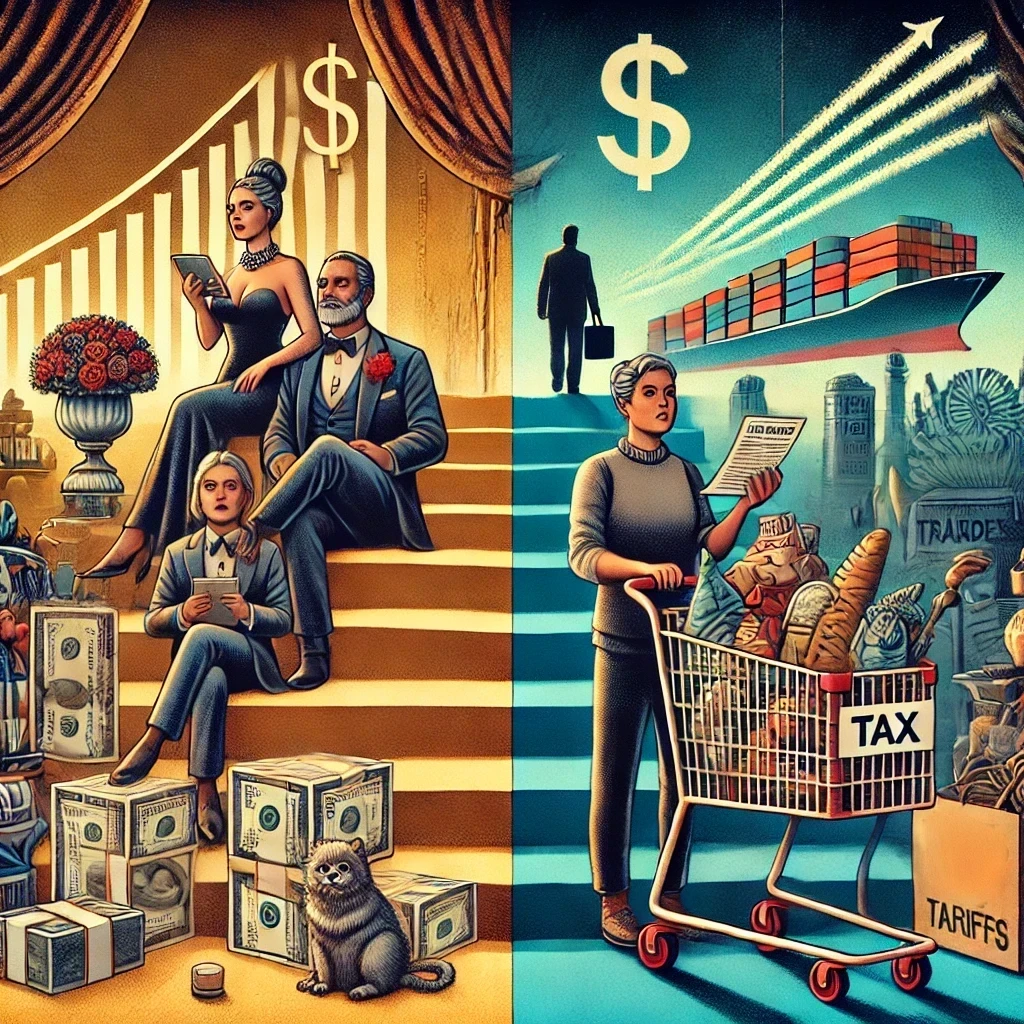

With the incoming administration planning to extend key provisions of the 2017 Tax Cuts and Jobs Act (TCJA), the winners and losers in this tax landscape are becoming clear. While the highest earners stand to benefit significantly, the middle class may find any modest gains offset by rising costs, particularly due to increased tariffs on Chinese imports.

High Earners Reap the Rewards

If you earn $450,000 or more annually, these tax cuts could mean a substantial boost to your finances. This income level places earners among the top 5% in the U.S., with after-tax income expected to rise by an average of 3.2%.

For those in the top 1%—earning $1 million or more annually—the benefits are even more pronounced. By 2027, this group could see an average tax cut of $70,000. Meanwhile, the ultra-wealthy in the top 0.1% (earning $5 million or more) could receive tax cuts averaging $280,000. These cuts underscore how the TCJA disproportionately benefits high-income earners.

Middle-Class Families Face Challenges

Middle-income households, defined as earning between $65,000 and $116,000 annually, might see a modest tax cut of around $1,000—an after-tax income increase of roughly 1.3%. However, the picture isn’t positive for everyone in this group. According to the Tax Policy Center, around 13% of middle-income households could actually see their taxes increase if these provisions are extended.

Compounding this challenge, tariffs on Chinese imports are likely to drive up the cost of goods that middle-class families frequently purchase, including everyday essentials like electronics, clothing, and household items. For many, this could offset the minimal tax cut they might receive—if they see any tax relief at all. Rising costs for these goods mean that any potential financial gains could evaporate quickly, leaving families feeling the pinch rather than relief.

The Cost of Extending Tax Cuts

Extending the TCJA isn’t without a hefty price tag, with projections estimating a $5 trillion impact on the federal budget over the next decade. Proponents argue that these cuts will stimulate economic growth and investment, but critics caution that they could exacerbate income inequality while adding to the federal deficit.

For middle-class families already grappling with inflation and rising costs for housing, healthcare, and education, the combination of minimal tax relief and higher prices for everyday goods paints a challenging picture. Meanwhile, the wealthiest Americans continue to enjoy substantial financial benefits, widening the gap between income groups.

The Bigger Picture

As these policies take shape, they highlight a larger debate: are these tax cuts effectively spurring economic growth, or are they leaving too many Americans behind? While the highest earners stand to gain significantly, the majority of Americans—especially those in the middle class—may find that their financial situation remains stagnant or worsens due to rising costs and insufficient tax relief.

Understanding your position in this shifting tax landscape is critical. Consulting with financial advisors can help you prepare for potential changes, ensuring you’re making the most of opportunities—or mitigating costly impacts. Ultimately, these policies raise fundamental questions about fairness, economic equity, and the nation’s fiscal priorities, especially as trade policies amplify the financial pressures on the middle class.