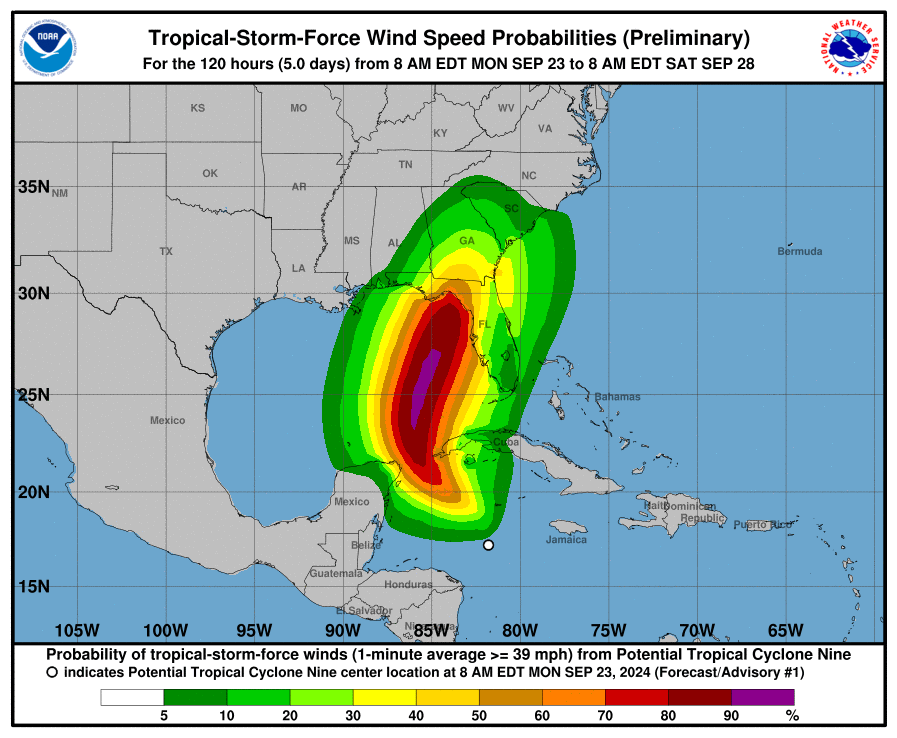

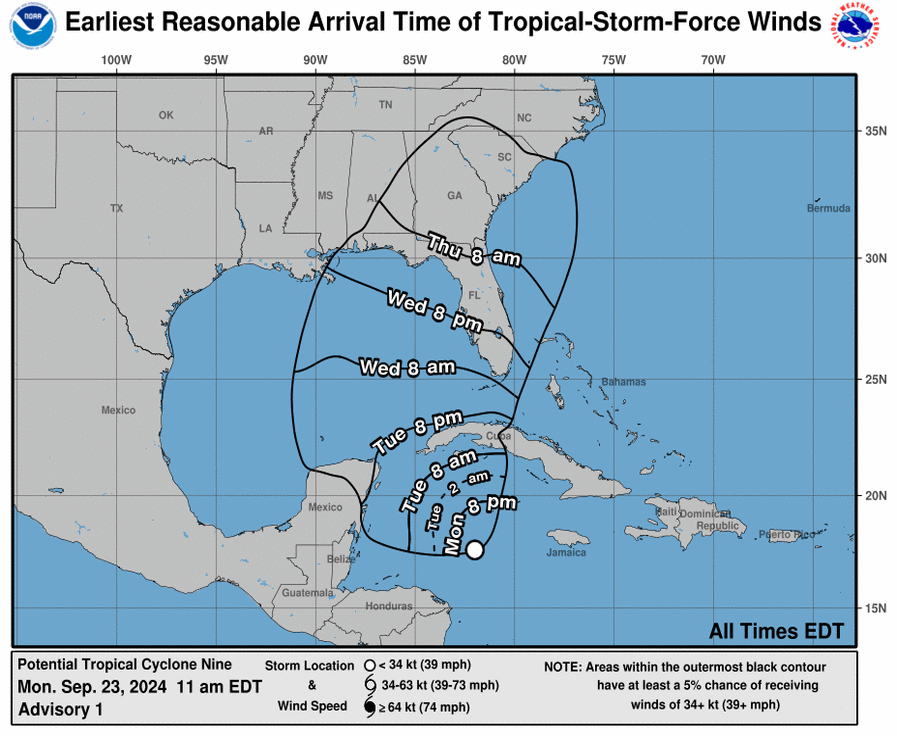

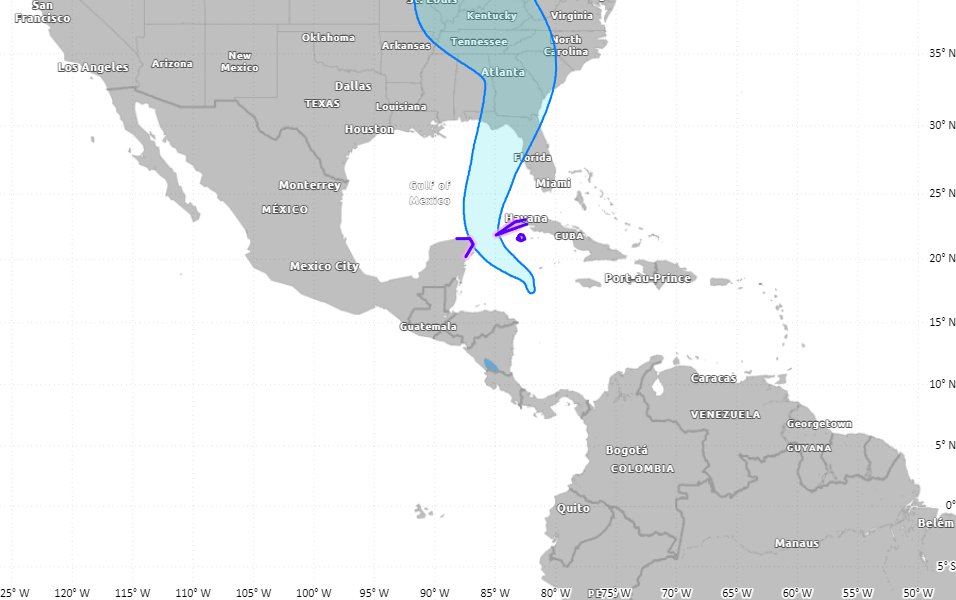

As Florida braces for another potential storm this hurricane season, all eyes are now on Potential Tropical Cyclone Nine. Currently positioned over the northwestern Caribbean Sea, the system is expected to strengthen into a tropical cyclone within the next 24 hours, with landfall along the northeastern Gulf Coast likely by Thursday.

The forecast of rapid intensification has sparked concerns not just over the potential physical damage but also the financial strain it could place on Florida’s Citizens Property Insurance Corporation, the state-backed insurer of last resort.

Citizens Property Insurance Corporation has grown substantially in recent years as private insurers have pulled out of the Florida market due to frequent hurricane damage and rising litigation costs.

With the state’s booming real estate market, particularly along its vulnerable coastlines, Citizens has become a critical lifeline for homeowners who are unable to obtain private insurance. However, Florida Governor Ron DeSantis recently raised alarm about the state insurer’s financial health, stating that “Citizens is not solvent.” This remark has heightened concerns about whether Citizens can manage the influx of claims that would follow a major storm like Potential Tropical Cyclone Nine.

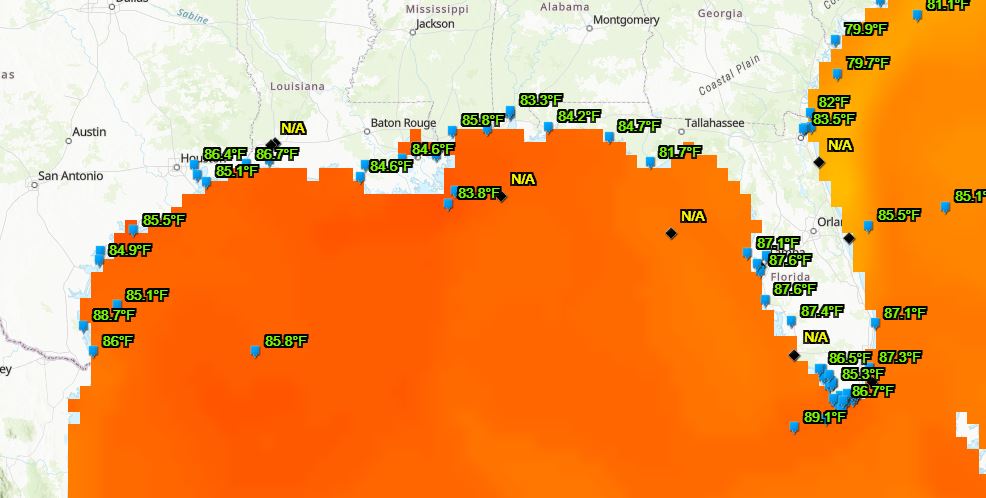

Although the storm is still in its early stages of development, the National Hurricane Center forecasts that it could become a hurricane as it moves into the eastern Gulf of Mexico. Some models even predict it could reach major hurricane status before making landfall, with winds of up to 110 mph. If the storm makes landfall at this strength, it could generate a massive wave of insurance claims, especially along the Panhandle and western Florida coastline, testing Citizens’ financial stability.

Citizens has been working to build its reserves, but a major hurricane could overwhelm its resources. If claims exceed the available funds, Citizens has the authority to levy assessments on all policyholders in Florida, including those with private insurance, to cover the losses.

This would likely result in higher premiums across the state, even for those not directly affected by the storm. Governor DeSantis’ concerns about Citizens’ solvency add another layer of uncertainty, as the potential financial shortfall could force the state to intervene, potentially diverting funds from other critical services.

In addition to the immediate financial strain, there could be significant delays in processing claims if the storm causes widespread damage. This could leave homeowners in a precarious position as they wait for financial assistance to begin rebuilding. If Citizens runs out of resources, the state government may be required to provide additional support, creating further financial stress on Florida’s budget.

With forecasts warning of heavy rain, storm surge, and damaging winds, residents along the Gulf Coast are urged to monitor the storm closely and prepare for potential impacts. As the system develops, it is becoming clear that Potential Tropical Cyclone Nine could serve as a major test for Citizens Insurance and Florida’s ability to manage the financial fallout from a large-scale weather event.

The next 72 hours will be critical in determining the storm’s path and strength as it moves into the Gulf of Mexico. For Floridians, especially those in high-risk areas, the looming storm underscores the financial vulnerabilities that come with living in a hurricane-prone state. Whether Citizens Insurance can withstand the potential onslaught or if systemic reforms will be necessary remains an open question, especially in light of Governor DeSantis’ warning about the insurer’s solvency.