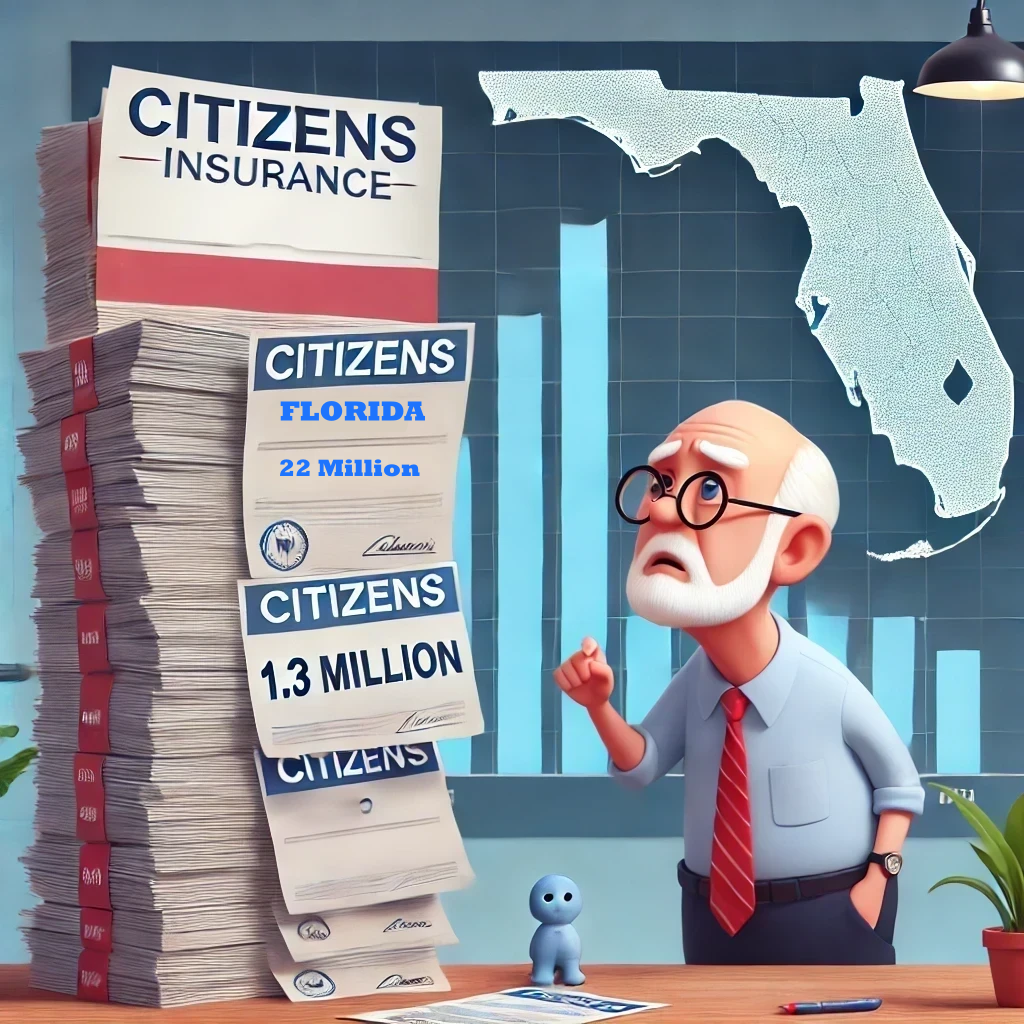

As Florida braces for the inevitable impact of a Category 5 hurricane, the state’s financial resilience is under scrutiny. Citizens Property Insurance Corp. (CPIC), Florida’s largest insurer, has requested a 13.5 percent rate hike. With 1.3 million policyholders as of 2023, if CPIC becomes insolvent, all Floridians with any type of insurance, including condo owners, could be on the hook for the bailout, even if they are not CPIC customers.

Critics argue that Florida residents are already burdened with exorbitant insurance costs. In 2023, the average annual premium for Florida homeowners was $10,996, significantly higher than the national average of $2,377. The state’s insurance market has seen some of the sharpest premium increases, with a significant portion of risk being transferred to reinsurance companies.

Governor Ron DeSantis has acknowledged the severity of the situation, stating that Citizens Property Insurance Corp. is not solvent and could face bankruptcy if a major hurricane hits.(2) The state’s strategy to stabilize the home insurance market involves reducing the size of Citizens by transferring policies to private insurers.

If Citizens were to exhaust its reserves and reinsurance following a major disaster, Florida law mandates that policyholders pay a special assessment of up to 45 percent of their premiums. This scenario could lead to a financial burden on all insurance policyholders in the state, as noted during an investigation by the U.S. Senate Banking Committee. Importantly, this assessment would not be limited to Citizens policyholders; even those with private policies on autos, boats, homes, and pets could face these additional charges to prevent Citizens from going bankrupt.(1)

Assessments are charges that both Citizens and non-Citizens policyholders must pay in addition to their regular policy premiums when additional funds are needed to pay policyholder claims due to a major storm, series of less severe storms, or other catastrophic events. Unlike a private insurance company, Citizens is required by law to levy assessments on its customers if funds to pay claims have been exhausted. For Citizens policyholders, assessments can be substantial.

Policyholders can be impacted even if they aren’t Citizens customers or don’t own a home. Except for the policyholder surcharge, which is paid only by Citizens’ policyholders, Citizens’ assessments can be charged on nearly every type of property and casualty policy, including homeowners, renters, auto, boat, and pet insurance policies.

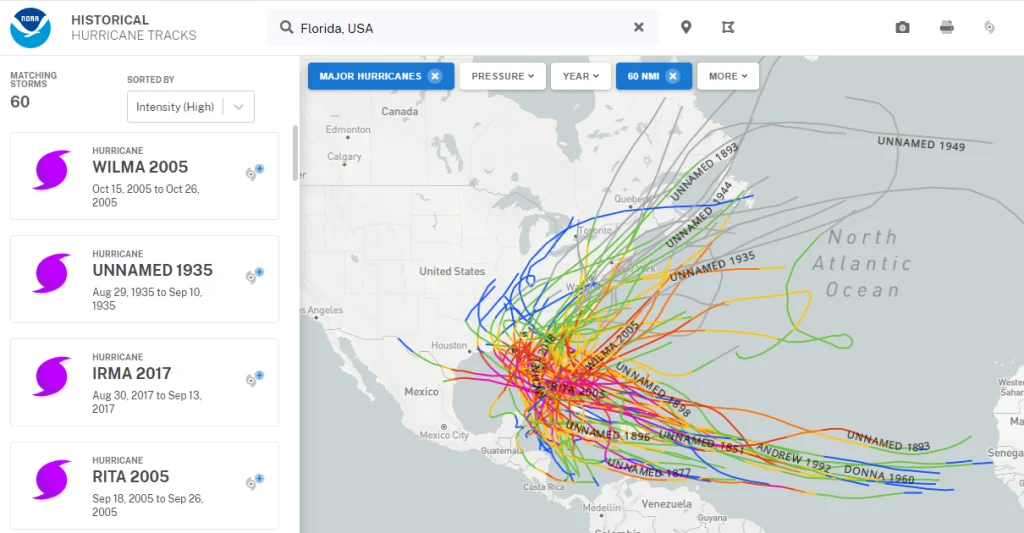

If a devastating storm or series of storms leaves Citizens in a deficit, the insurer is required to levy a Citizens Policyholder Surcharge. If a deficit remains after this surcharge, an emergency assessment of up to 10 percent per year on assessable statewide premium, including Citizens and private-market policyholders, would be imposed for as many years as necessary until the deficit is eliminated. With 60 Category 3+ hurricanes making Florida landfall in recent history, this is not a hypothetical what if, but when.

The historical context of Hurricane Andrew in 1992, which caused $26.5 billion in damage and bankrupted 11 private insurance companies, serves as a stark reminder of the potential financial fallout. Citizens has stated that they are able to pay all claims and have 4.6 billion of cash on hand.

In recent years, smaller in-state insurance companies have taken on a larger share of policies as major insurers like Allstate and State Farm retreated from the market. These start-ups often rely heavily on reinsurance, sometimes using up to half of the policy premium to cover claims. However, many have neglected to build adequate reserves, focusing instead on affiliated businesses. This approach has left the market vulnerable, as demonstrated by the state’s takeover of firms unable to meet their claims obligations.

Despite new regulations requiring homeowners with Citizens Insurance to purchase Federal Flood Insurance, the number of Citizens policies surpassed 1.3 million in June 2023. Efforts to depopulate these policies are ongoing, but Governor DeSantis admitted that Citizens remains underfunded and unable to handle a major hurricane without significant financial strain. It may end up that all 22 Million Florida citizens with any insurance policy foot the bill.

As the decision on the rate hike looms the financial future of Florida’s insurance market hangs in the balance. The state faces a critical juncture, where the need to ensure solvency and preparedness for catastrophic events must be weighed against the financial burden on its residents. The specter of a Category 5 hurricane serves as a grim reminder of the urgent need for robust financial planning and strategic risk management.

(1)Link to Citizens Property Insurance Assessment Page: Here