In Florida, the insurance crisis gripping the condominium market is now casting a long shadow over mortgage options available to potential condo buyers, with repercussions felt across the real estate financing landscape. This troubling trend has been exacerbated by legislative changes under Governor Ron DeSantis’ administration, adding layers of complexity for buyers, sellers, and financial institutions alike. When the risk of insuring a property is too high, the risk of lending on the same property follows suit.

A stark indicator of the deepening crisis is the recent decision by Provident Funding Associates LLC to exit the condo lending business in Florida. The California-based lender announced it would stop accepting new applications for condominiums immediately, a move that signals growing concern among financial institutions about the viability of such investments. Provident, known for its conservative lending practices and low delinquency rates, represents just the tip of the iceberg as other lenders may follow suit given the escalating risks.

The root of the issue lies in the insurance sector, where skyrocketing premiums and diminishing coverage options have made it increasingly difficult for condo associations to secure affordable policies. The issue is only projected to get worse as climate change continues to increase the severity of hurricanes in the region.

This insurance upheaval stems in part from the aftermath of the tragic Surfside condo collapse in 2021, which led to heightened scrutiny and regulatory changes aimed at preventing similar disasters. The Condo Safety Act enacted in response requires that condo associations conduct detailed structural integrity assessments and set aside sufficient funds for necessary repairs and maintenance—a costly mandate that has driven up insurance costs.

As insurance premiums rise, the financial burden has deterred potential condo buyers, who are wary of the significant and unpredictable costs associated with maintaining older buildings. This hesitance has led to a glut in the market, particularly for units in older buildings, pushing down prices and swelling inventories. The median list price for a condo in Miami-Dade County dropped significantly from its peak in July 2022, accompanied by a sharp increase in available units.

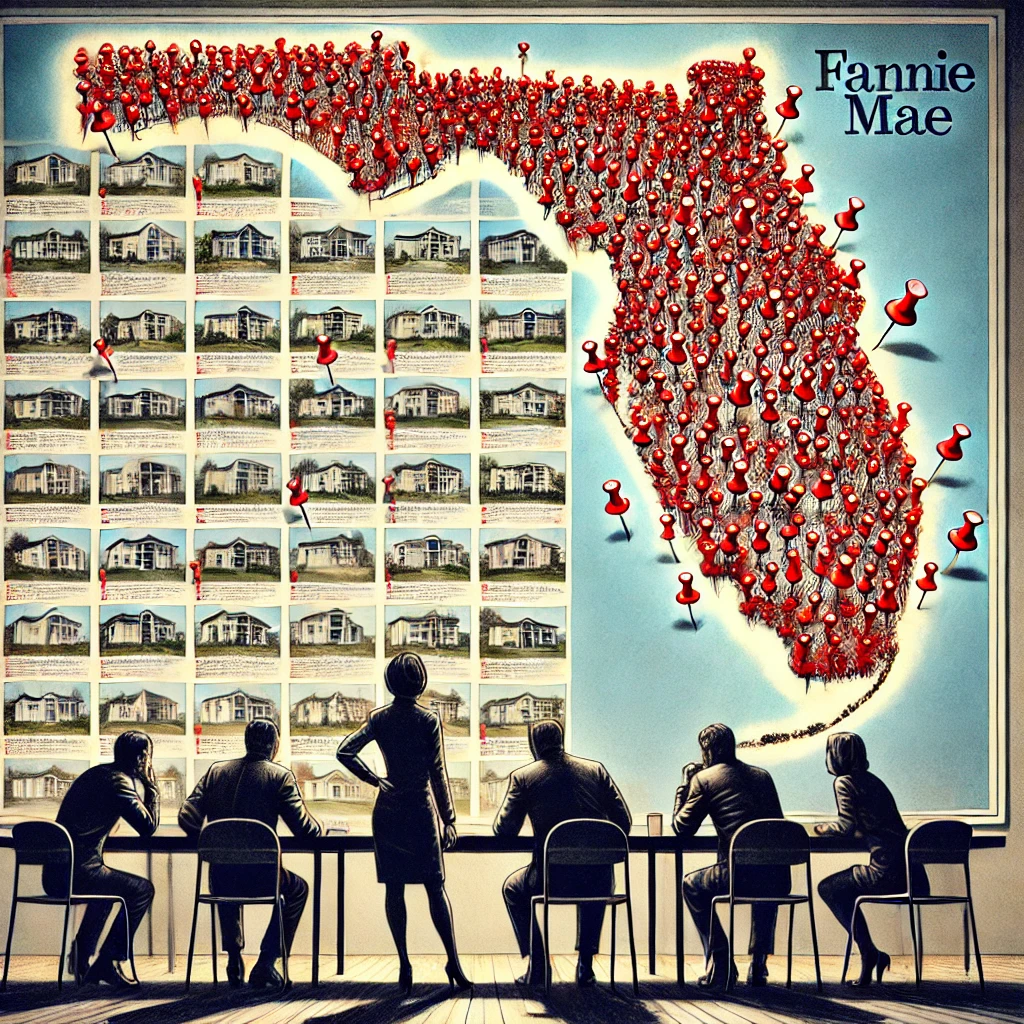

The insurance crisis has directly influenced mortgage lending practices. Government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac have tightened their lending criteria in response to these risks. These entities have permanently adopted stricter guidelines initially put in place after the Surfside collapse, refusing to finance condos in projects that delay critical repairs or that local authorities have flagged for safety concerns. Fannie Mae has even blacklisted approximately 1,400 condo associations, a move that underscores the severity of the issues facing the market.

This shift in mortgage lending criteria is reshaping the condo purchase landscape in Florida. Buyers are finding it harder to secure financing, particularly for older or riskier properties that fail to meet the new, stringent safety and financial health checks. This trend is likely to persist, potentially leading to a significant contraction in the market for older condos, which could drive a wedge through the heart of Florida’s condo real estate sector.

The consequences of the intertwined insurance and mortgage lending crises are profound. They signal a move towards a more conservative approach to real estate financing and ownership in Florida, particularly in the condo market. As these sectors adjust to the new realities, potential buyers must navigate an increasingly complex landscape, where understanding the intricate relationship between building safety, insurance viability, and mortgage availability becomes crucial.

Governor DeSantis’ legislative reforms, while intended to enhance safety and accountability, have inadvertently catalyzed these shifts, fundamentally altering the dynamics of condo ownership and financing in the state. As Florida grapples with these challenges, the condo market remains a critical barometer of the broader health and stability of the state’s real estate sector.