Home insurance rates in the United States are set to reach unprecedented levels in 2024, largely due to the impacts of climate change. According to Insurify, a leading insurance comparison platform, the average annual premium is expected to climb to $2,522 by the end of this year, marking a 6 percent increase from the previous year.

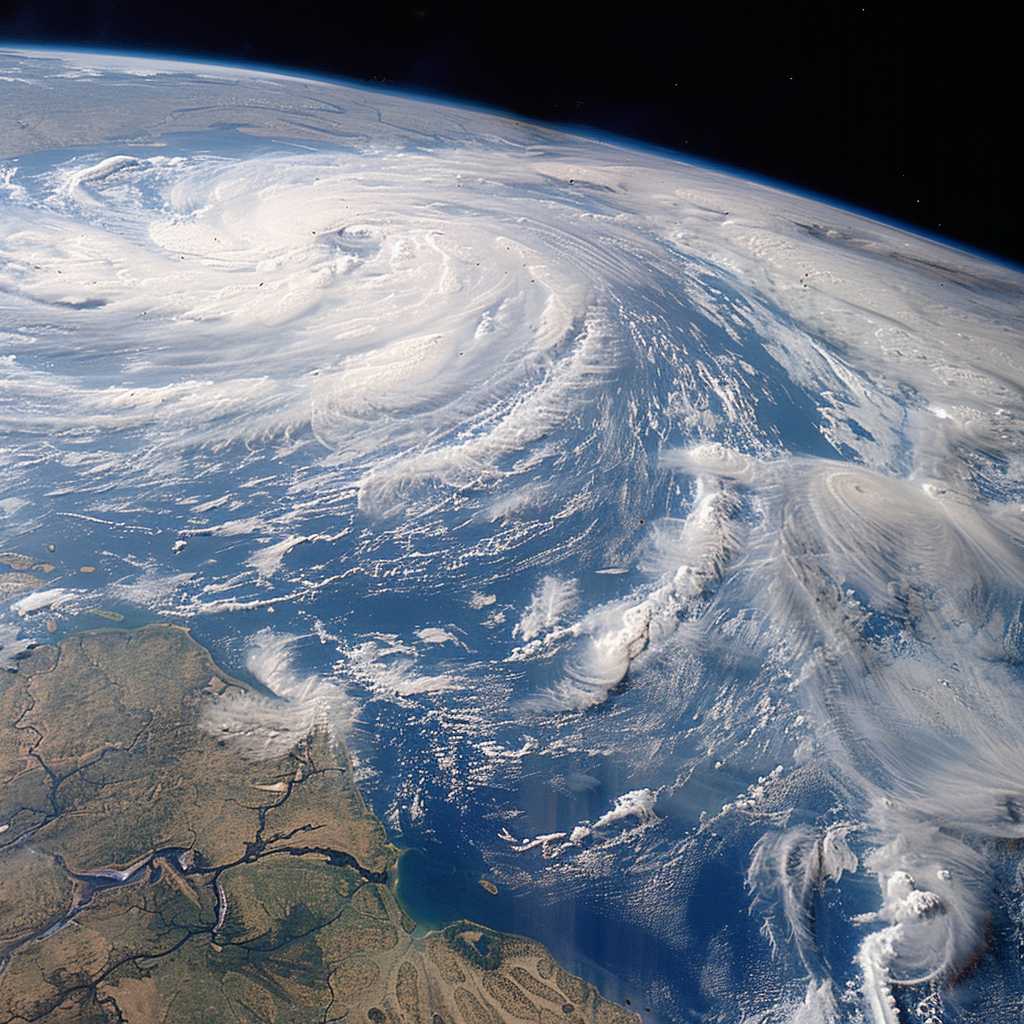

This surge in insurance costs has been fueled by a combination of factors, including a 20 percent hike over the last two years. Escalating natural disasters, dwindling competition among insurers in certain regions, and rising repair expenses for homes have all contributed to this trend.

For many Americans, the soaring costs of home insurance are becoming increasingly unaffordable, prompting some to consider foregoing coverage altogether. However, certain states are bearing the brunt of these increases, with those susceptible to natural disasters facing average annual premiums as high as $12,000.

Florida, known for its vulnerability to hurricanes and other extreme weather events, already holds the title for the highest home insurance premiums in the nation. Residents in the Sunshine State paid an average of $10,996 annually in 2023, a figure set to climb even higher to $11,759 this year.

Louisiana ranks second in terms of high insurance rates, with homeowners shelling out an average of $6,354 annually – nearly three times the national average. Insurify predicts a staggering 23 percent increase in premiums for Louisiana in 2024, pushing the average premium to $7,809.

The effects of climate change are amplifying the risks of severe weather across the country, impacting states like Maine, which historically had lower-than-average insurance rates. Rising sea levels and coastal storms are projected to cause a 19 percent jump in premiums for Maine this year.

The frequency and severity of natural disasters have been on the rise, with a record 28 climate disasters in the US last year alone, each causing at least $1 billion in damages. In Florida, the situation has been exacerbated by costly disasters like Hurricane Ian, which caused $109.5 billion in damage in 2022.

Insurers rely on reinsurance coverage to mitigate their exposure to losses from natural disasters. However, securing reinsurance has become increasingly difficult in states like Florida, where insurers are grappling with mounting risks and rising costs.

As insurers withdraw coverage from high-risk properties, state-run insurers of last resort, such as Florida’s Citizens Property Insurance Corporation, are stepping in to fill the gap. However, the long-term sustainability of such arrangements remains uncertain.

The escalating costs of home insurance, driven by climate change and escalating natural disasters, pose significant challenges for homeowners across the United States. As insurers grapple with mounting risks and rising costs, the future availability of home insurance in high-risk areas hangs in the balance.