Canada has significant tools at its disposal to respond to U.S. tariffs, particularly if such measures were imposed on Canadian goods as part of trade tensions. One of the most impactful options is leveraging its role as a key supplier of energy and natural resources to the United States, a move that could disrupt supply chains and significantly affect U.S. consumers and businesses.

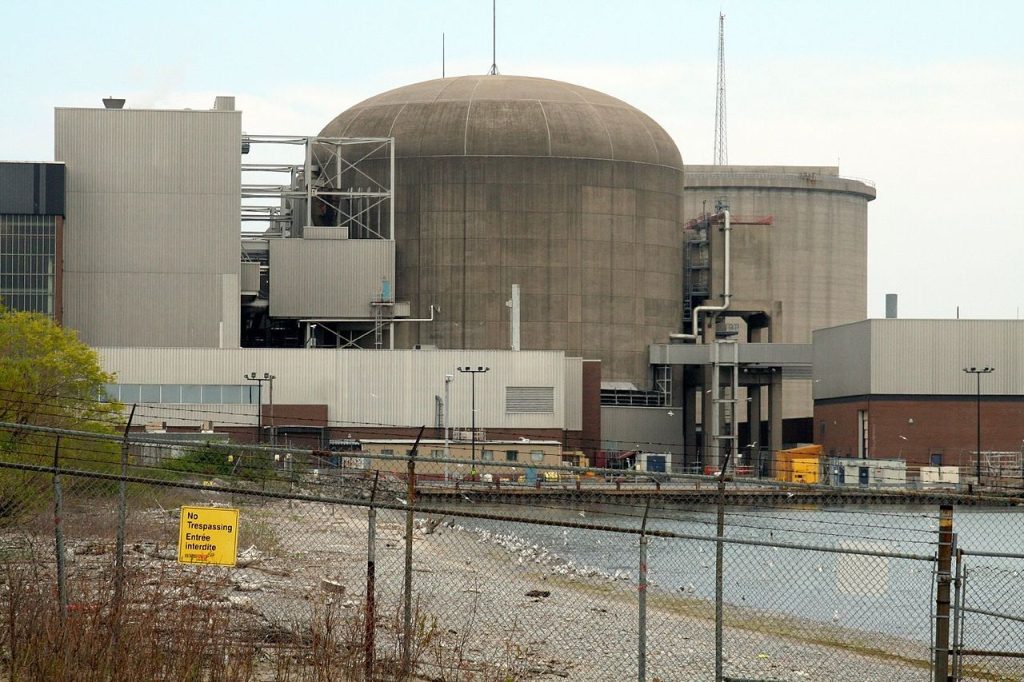

Ontario, Canada’s most populous province, plays a vital role in U.S. energy supply chains, particularly for states like Michigan, Minnesota, and New York. In 2023 alone, Ontario’s energy exports powered over 1.4 million U.S. homes. If Ontario or other provinces reduced or halted electricity exports in response to tariffs, it could strain power grids in these states and drive up energy costs, especially during peak demand seasons. This calculated response could prompt political and public backlash within the U.S., putting additional pressure on policymakers.

Canada is also the primary supplier of crude oil to the U.S., accounting for 60% of U.S. crude imports. This reliance is particularly significant in the Midwest, where refineries are optimized for Canada’s heavier crude. If Canada were to restrict or stop oil exports, gas prices in states like Michigan, Wisconsin, Ohio, Indiana, and Illinois could rise by an estimated 30 to 50 cents per gallon. These increases would result from both the scarcity of suitable oil and the logistical challenges of sourcing alternative supplies. The Northeast, which also imports some Canadian crude, could experience smaller price hikes, while states across the country would feel the ripple effects as national oil supplies tighten.

Even with increased domestic oil production, the U.S. cannot easily replace Canadian imports. Much of the crude produced domestically is light and sweet, which does not align with the configuration of many U.S. refineries that rely on Canada’s heavier crude. Adapting refineries or sourcing oil from alternative suppliers, such as Venezuela or the Middle East, would take time and incur additional costs, further elevating prices. Experts predict that gas prices in affected regions could remain elevated for weeks or months, straining household budgets and increasing transportation costs for businesses.

Beyond energy, Canada’s position as a critical trade partner to the U.S. offers other avenues for retaliation. Restrictions on agricultural exports, for example, could drive up food prices, while limitations on key materials like aluminum or lumber could increase costs in housing construction and manufacturing. Combined, these measures would impact multiple sectors of the U.S. economy, underscoring the interconnected nature of North American trade.

Canada also has options to strengthen its global trade alliances, potentially isolating the U.S. economically and politically. By reinforcing partnerships with other nations affected by U.S. tariffs, such as those in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Canada could build a coalition to counterbalance U.S. economic influence. Canadians export a lot of dairy products to Europe, with decreased profits in the U.S. these export channels could be strengthened.

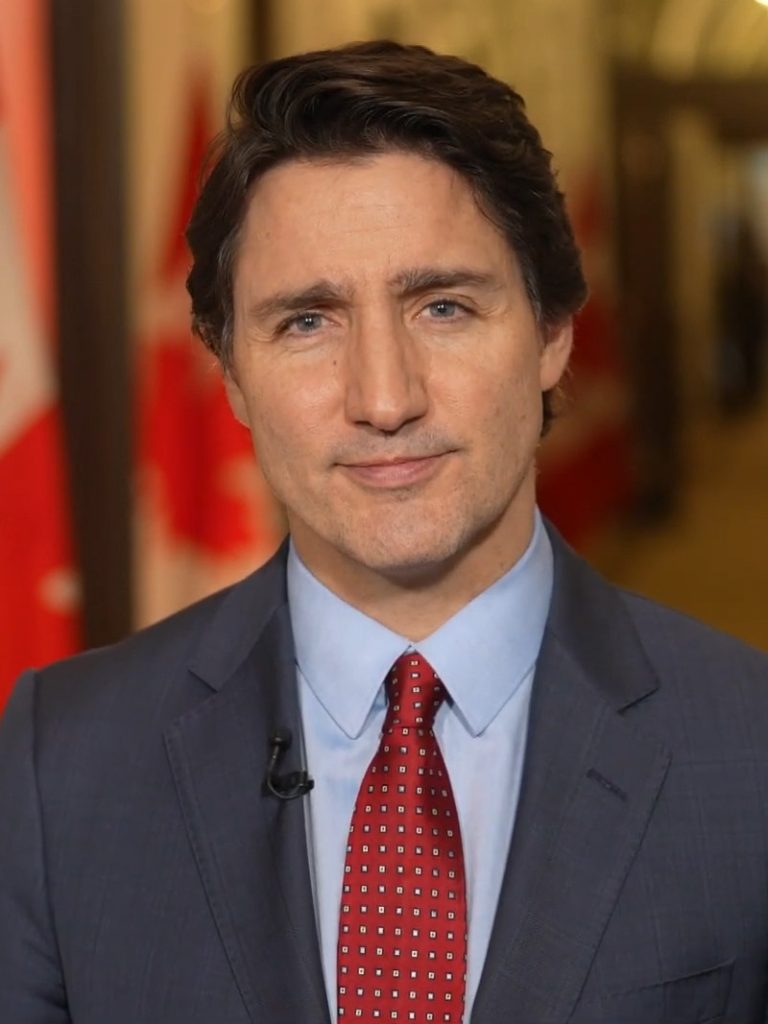

While Canada’s Trudeau would prefer to maintain amicable trade relations, these potential retaliatory measures demonstrate the seriousness of its position. Disrupting energy exports and exploring other trade restrictions would have widespread consequences, making it clear that Canada is willing to defend its interests against protectionist U.S. policies. The situation highlights the importance of diplomacy in resolving trade conflicts, especially between two nations as closely tied as Canada and the United States.