The state of California recently proposed a bill that would target wealthy residents who left the state. While the proposal was shot down, residents who maintain ties to the state may be subject to California taxes, the highest in the country.

Contrary to popular belief, the exit tax was never intended to tax any Californian who relocates to another state. Rather, the bill was aimed at California’s more wealthy residents, who make up almost half of the state’s personal income tax revenue.

California has some of the highest income taxes in the country and the state is facing some other major issues, such as high homeless population, impossibly high prices, an immigration crisis, and according to a recent state audit, an unprecedented budget deficit.

These qualities make it very difficult to operate businesses in the state, and thus there have been hundreds of businesses closing their doors in California and fleeing to more low income or no income tax states such as Texas, Nevada, or Florida.

The wealth tax proposed by Democrats last winter was an alternative to spending cuts. It would impose a 1.5% tax on the net worth of individuals with a higher net worth than $500 million. Additionally, part-time residents would also be charged the tax, regardless of how much time they are spending out of state.

This tax was projected to help in cutting down California’s $68 billion deficit, however the wealth tax would not be applicable to those who completely sever ties with the state.

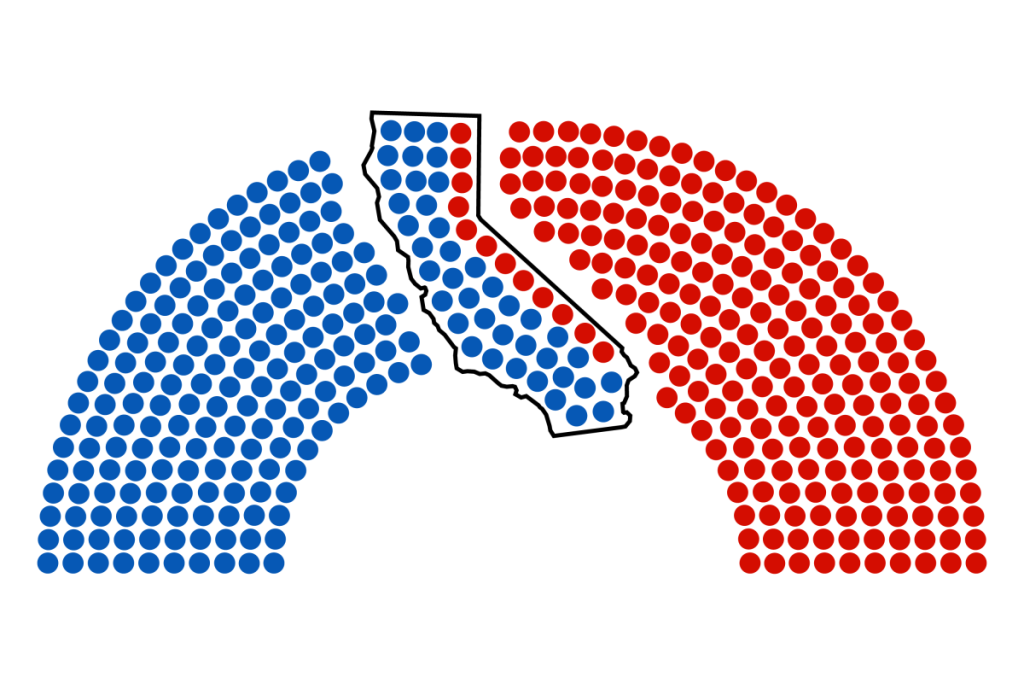

Gov. Gavin Newsom opposed the bill in January; however, it would be of no surprise if another proposal popped back up in its place. It is no secret that California relies heavily on the taxes of their more affluent residents, a glaring issue in the tax structure of the state.

Despite the tax being vetoed, residents who leave the state but remain connected through businesses or properties may still be subject to pay California taxes by the Franchise Tax Board (FTB). Any income earned in California or from California sources is subject to the state’s income tax.

Seeing as California is backed by a two-thirds Democratic majority, a similar tax may pop up in its place, but for now the state does not exercise an exit tax. According to Newsom’s recent press conference on state spending, it appears the state will focus on spending cuts and cracking down on more reasonable budget allocation in order to tackle the deficit.

States like California and New York are typically the first states to enforce new taxes, so it’s not unreasonable to assume that other states may try to impose wealth or exit taxes on residents as well, especially those state which rely on taxes from wealthy residents.

Although the exit tax did not prevail, California will need to make headway in cutting down it’s alarming state budget deficit in order to appear desirable to affluent residents and potential residents. With the 1% making up almost half of the tax revenue for the state, they are in a difficult position that requires them to retain their wealthy residents.