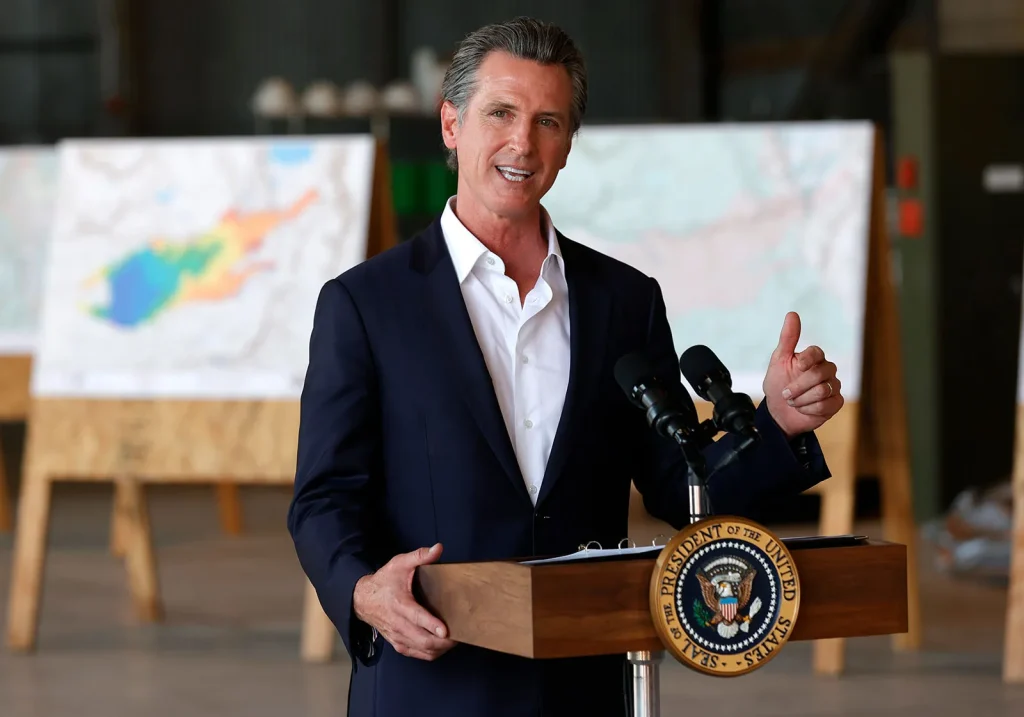

Insurers are retreating from California’s homeowners’ market, prompting Governor Gavin Newsom to push for faster reviews of rate hike requests to prevent further exits.

Newsom emphasized the urgency of stabilizing the market, noting insurers’ actions like non-renewals and policy cessations, which force homeowners to resort to the state’s FAIR Plan, already burdened with over $300 billion in payouts.

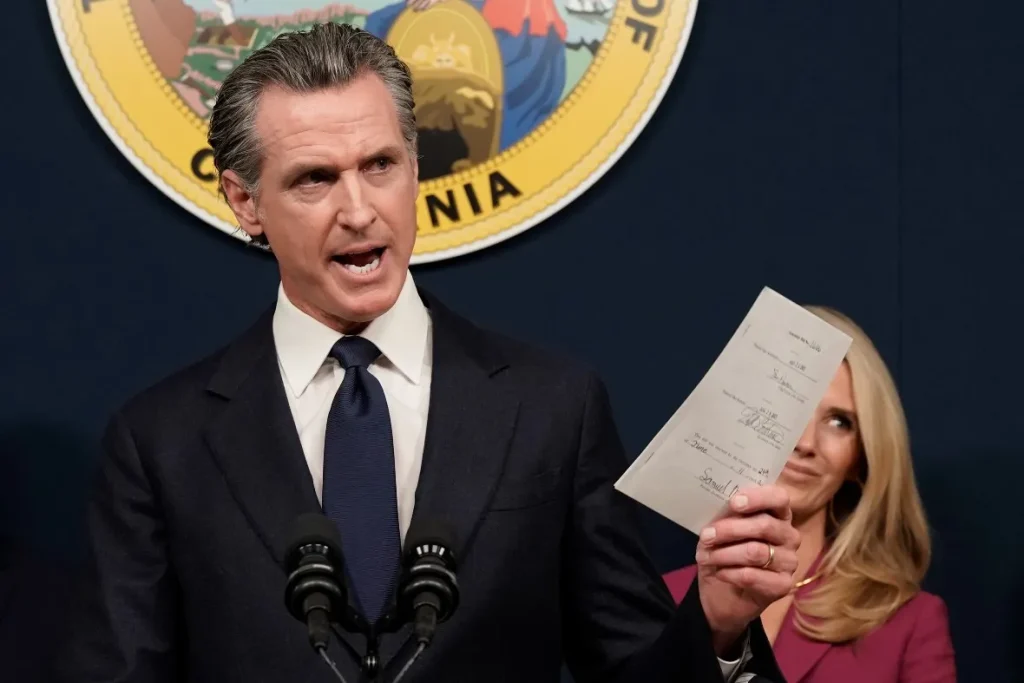

To address this, Newsom supports a bill mandating the Department of Insurance to complete reviews of proposed premium increases within 60 days, aiming to halt market exits.

Rather than an executive order, Newsom prefers legislative action to expedite rate-hike reviews, stressing the need for swift market stabilization.

Though Insurance Commissioner Ricardo Lara is pursuing broader reforms through the Sustainable Insurance Strategy, these won’t be law until year-end, prompting Newsom’s call for immediate action.

Newsom’s proposed bill complements Lara’s efforts, aiming to expedite rate approvals amidst ongoing negotiations between Lara and the insurance industry.

Lara acknowledges progress in reform implementation but highlights the ongoing need for collaboration with the governor and Legislature.

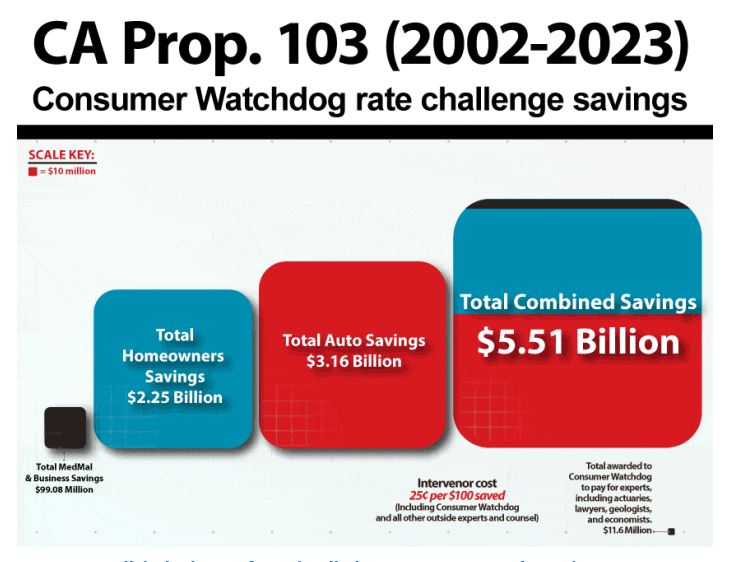

Consumer groups express concern over the proposal, fearing it might streamline rate increases without adequate scrutiny, citing existing mandates under Proposition 103.

The insurance industry, represented by Rex Frazier, awaits the bill’s draft language before offering a formal response, highlighting concerns over extended review timelines.

Next steps involve the release of the draft bill by Newsom’s office, its adoption in the state budget process, and legislative approval by mid-June, amid efforts to address a significant budget shortfall.